If you are a Stonegate tenant, you are currently operating inside one of the most leveraged financial experiments in British history. While you are worrying about the price of a CO2 canister or your Sunday staffing levels, your landlord is staring at a £3 billion debt mountain.

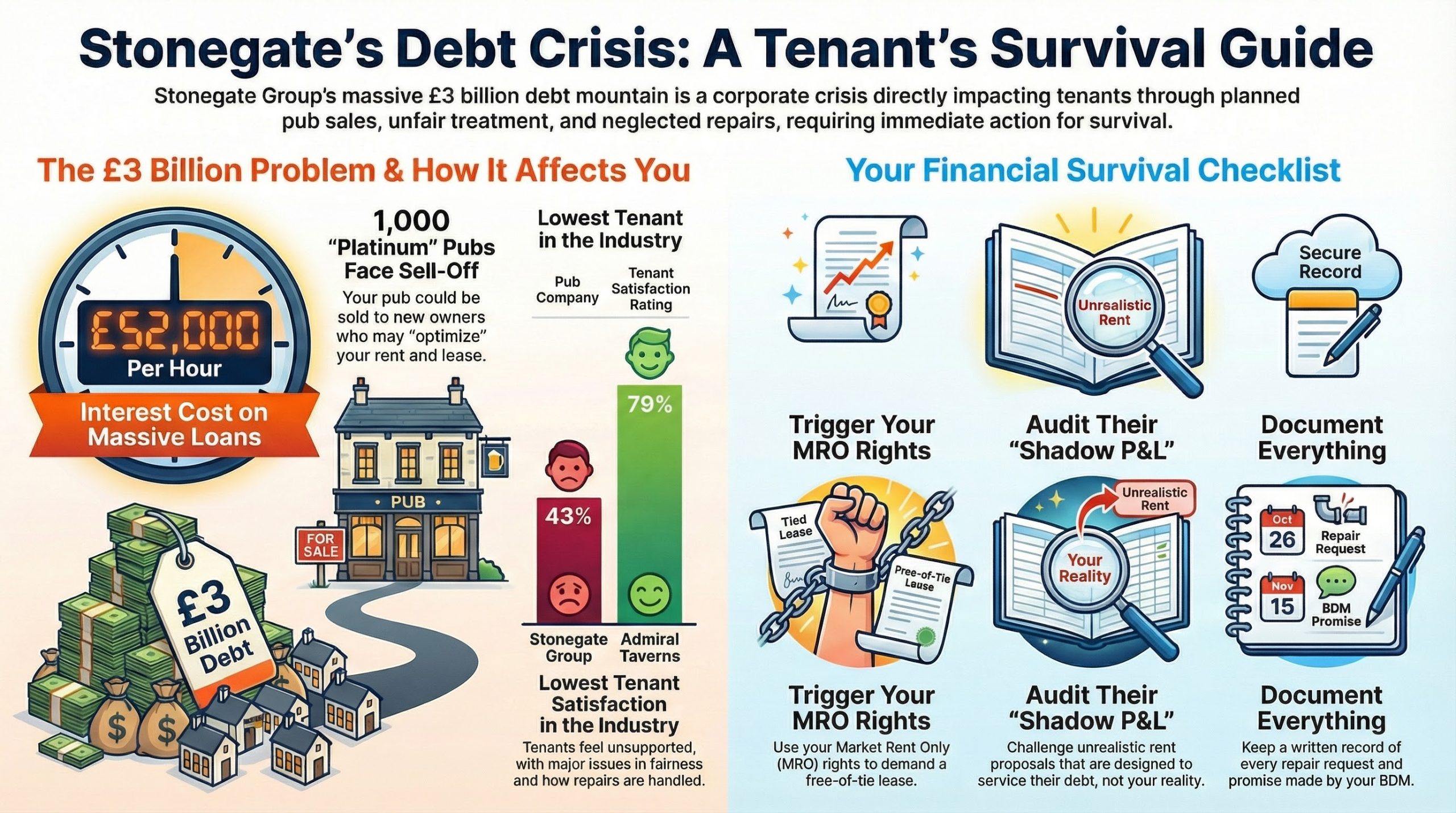

The latest Stonegate Group financial statements for 2024 reveal a staggering reality: the company’s finance costs have hit £455 million annually. To put that in perspective, every single hour of every single day, Stonegate needs to find roughly £52,000 just to pay the interest on its loans.

[Inference] Based on observed patterns, when a landlord’s interest bill exceeds their total revenue from many segments, that pressure doesn’t stay at the head office—it rolls downhill directly to your bar.

1. The £1 Billion “Platinum” Liquidation

To tackle this crisis, Stonegate is reportedly preparing to sell off over 1,000 of its most valuable “platinum” pubs in a transaction valued at approximately £1 billion.

- The Paradox: These aren’t the failing pubs; they are the “strongest assets” in the estate.

- The Reason: They have been “ring-fenced” into a separate entity to allow management to sell them without destabilizing the rest of the business.

- The Risk to You: If your pub is sold to a new, smaller operator or a different private equity group, your “Tied” status and your rent levels are the first things they will look to “optimize” to recoup their investment.

2. Why Satisfaction is at an All-Time Low

It is no coincidence that Stonegate remains at the “bottom of the league table” in the 2025 PCA Tied Tenant Survey. With an industry-low satisfaction rating of just 43%, Stonegate tenants are statistically nearly twice as likely to feel “unsupported” compared to those at Admiral Taverns (79%).

- The Fairness Gap: Only 45% of Stonegate tenants feel they are treated fairly.

- The “Repair” Crisis: Fewer than half (47%) of Stonegate tenants feel they understand the repair process, and a massive 62% are dissatisfied with how repairs are handled.

- The BDM Disconnect: Only 55% of Stonegate tenants are satisfied with their BDM relationship.

[Inference] Based on observed patterns, when a company is losing £214 million a year (pre-tax), BDMs are often incentivized to focus on rent collection and “wet rent” enforcement over genuine partnership.

3. Your “Financial Survival” Checklist

If you are one of the thousands of tenants caught in the Stonegate web, you cannot afford to be passive. You are competing with their bankruptcy fears, and you need a “Digital Union” to protect your interests.

- Trigger Your MRO Rights: Don’t wait for a rent review. If your pub is being sold or your BDM is pushing a non-compliant agreement, use your Market Rent Only (MRO) rights to demand a free-of-tie lease.

- Audit Your “Shadow P&L”: Stonegate’s survival depends on extracting maximum “divisible balance” from your site. If their rent proposal feels like fiction, it’s because it probably is.

- Document Everything: Since only 58% of tenants know how to contact their Code Compliance Officer (CCO), make sure you are in the 42% who do. Every repair request and BDM promise must be in writing.

4. Take Control with Smart Pub Tools

We didn’t build our SaaS to “help you manage”; we built it to help you survive.

- The Law Assistant: Use the Ultimate Pubs Code Law Assistant to review your Stonegate lease today. We provide the “Fix It” letters and MRO notice templates specifically designed to counter the tactics being used by distressed Pubcos.

- The Margin Protector: Stonegate wants you to sell more barrels to service their debt. You want to sell more food to service your family. Use the Sunday Roast Forecaster to ensure your busiest day is optimized for your profit, not theirs.

The Final Word

Stonegate’s £3 billion debt isn’t just a number in a boardroom—it is a daily tax on every pint you pour and every repair they ignore. By arming yourself with data and legal leverage, you stop being an “asset to be liquidated” and start being a business owner in control.