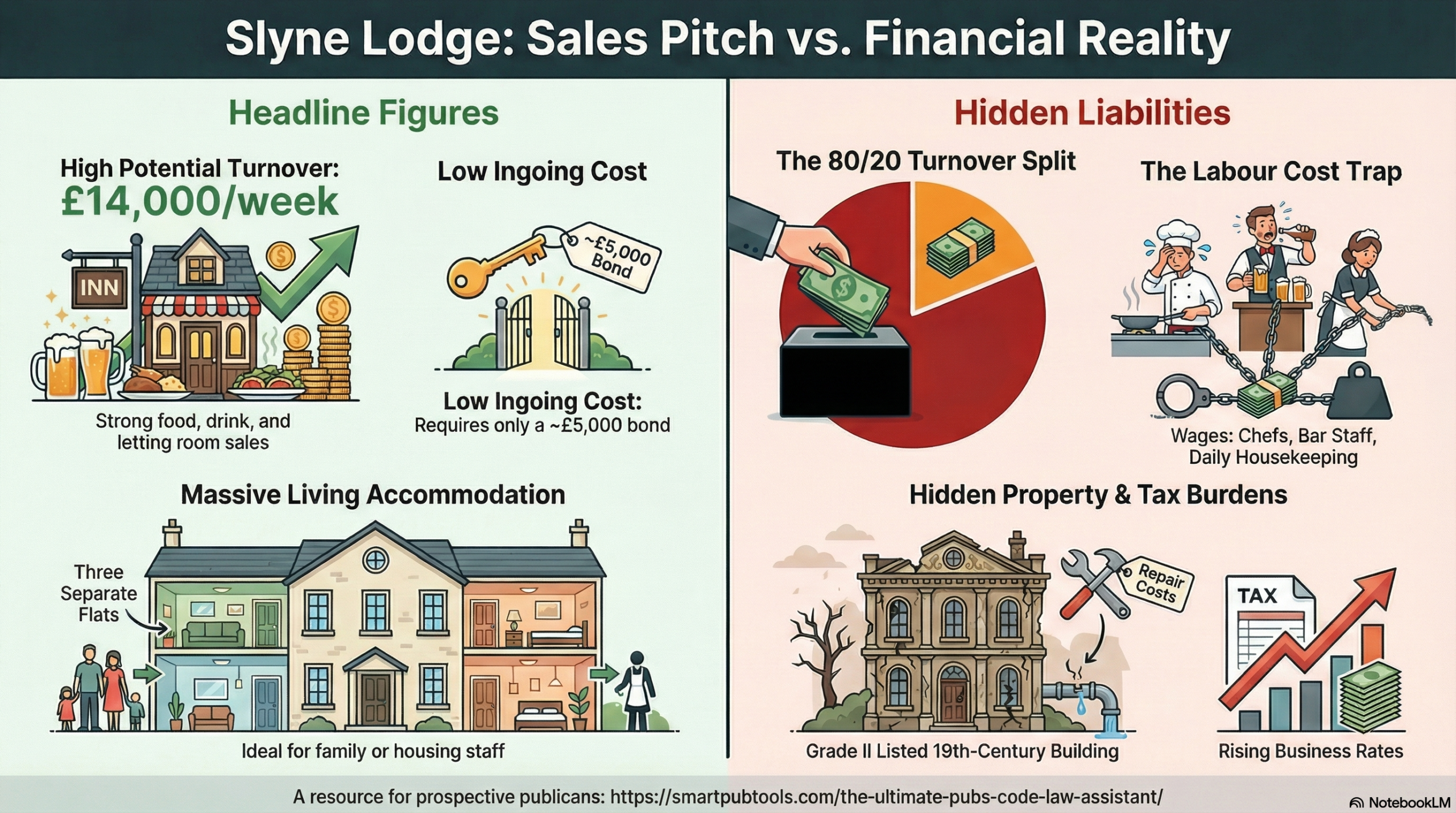

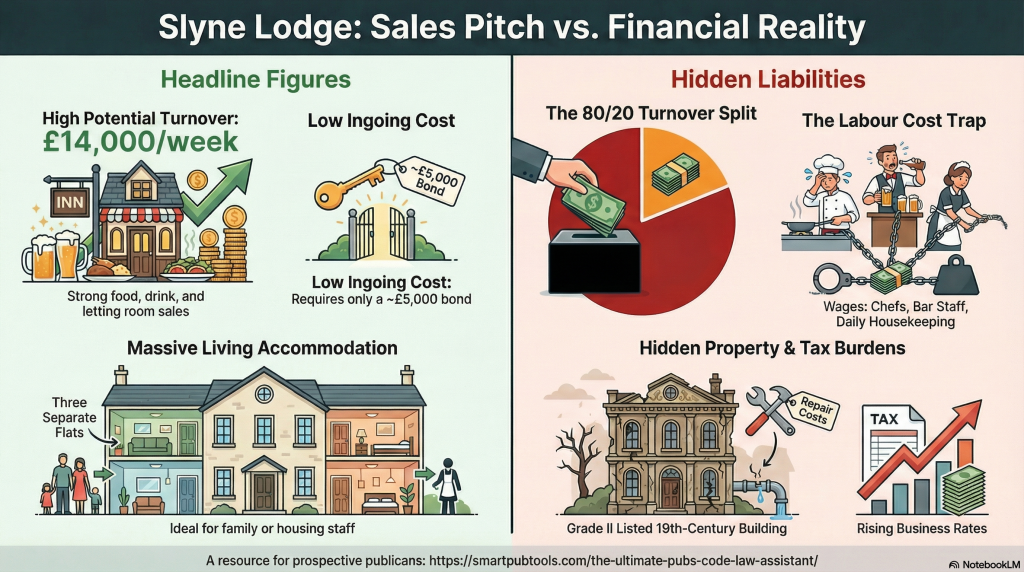

The Slyne Lodge Hotel is an appealing prospect: a historic, Grade II listed building at the heart of the village of Slyne-with-Hest, once one of its premier residences. This picture of a classic pub opportunity, however, is governed by a thoroughly modern contract. The Marston’s “Retail Agreement” for this site is not a traditional tenancy or lease. It is a franchise-style model where the operator is not a tenant paying rent, but a manager contracted to run the business. The financial reality is stark: the operator retains just 20% of the total weekly turnover. From this fixed percentage, they are responsible for paying all staff and associated employment costs, along with their own income. This structure creates the central challenge of the agreement: the operator is burdened with 100% of the single largest and most volatile cost—labour—while being allocated only 20% of the turnover to cover it, a model that can quickly become a financial trap.

2. The Financial Reality Check: Can You Run a Hotel on a 20% Retainer?

2.1 The Deal on Paper: Deconstructing the “Retail Agreement”

The Marston’s agreement is not a conventional lease where you pay rent. Instead, it operates on a retained income model. The core financial terms are as follows:

• The Operator’s Share: The operator’s gross income, termed the “Service Fee”, is fixed at 20% of the “Total Weekly Turnover” (Clauses 7.5 and 1.1.26).

• Marston’s Share: Marston’s receives a “Management Charge,” which is equal to 80% of the “Total Weekly Turnover” (Clause 7.3).

• Operator’s Responsibilities: From this 20% Service Fee, the operator is solely responsible for all employment costs, including wages, taxes, and national insurance for all staff (Clause 5.1.5).

• Stock Discrepancy Penalty: If a stock or cash audit reveals a discrepancy of more than 1.5%, Marston’s has the right to deduct the value of that discrepancy from the operator’s Service Fee (Clause 6.18).

2.2 Measuring Against Industry Norms

The 20% Service Fee is intended to cover all of the operator’s costs, with the largest of these typically being labour. When measured against established industry benchmarks, this figure is exceptionally tight and sits well below established industry viability benchmarks.

According to industry data, typical labour costs alone represent a significant portion of a hospitality business’s turnover:

• Food-centric pub: Labour costs average around 29% of sales.

• Restaurant: Labour costs average around 35% of sales.

The implication is stark: the 20% “Service Fee” provided by Marston’s is fundamentally misaligned with industry reality. It is significantly less than the typical cost of labour alone for a food-led pub, meaning an operator must find a way to pay for staff, themselves, and all other business-running expenses from a sum that the industry already considers insufficient for just one cost category. Furthermore, benchmark data shows that a typical pub’s Trading Profit After Rent (EBITDA) is between 10.6% and 11.8%. This profit is what remains after all operating costs have been paid, making a 20% gross retainer from which all costs must be covered look extremely challenging.

2.3 The “Killer Question” for Slyne Lodge

The challenge is amplified by Slyne Lodge’s status as a hotel with accommodation. Running hotel rooms requires significant additional labour for housekeeping, cleaning, and laundry, which is not a factor in a standard wet-led or food-led pub. The viability of operating Slyne Lodge under this model hinges on a single, crucial financial detail that the standard agreement does not address, best summarized by the “Killer Question”:

“Given the 20% sales mix from Rooms, does the Retained Sum calculation include a specific ring-fenced allowance for Housekeeping wages, or am I expected to clean 10 rooms a day out of the standard wet-led percentage?”

3. Operational Headwinds: Industry Risks on a Razor-Thin Margin

3.1 A Perfect Storm for the Pub Sector

The financial model of the Retail Agreement exists within a UK pub sector facing severe and unprecedented economic pressures, as detailed in a recent industry report.

• Massive Cost Increases: Pubs are facing combined cost pressures of up to 43% due to inflation in food, drink, energy, and labour.

• Weaker Consumer Demand: As a result of the cost-of-living crisis, 35% of consumers reported that they planned to eat and drink out less frequently.

• Rising Insolvencies: After the end of government support schemes, pub insolvencies rose by 76% in the first half of 2023.

3.2 The Operator’s Burden

These industry-wide risks are magnified by the fixed-retainer structure of the Retail Agreement. While the operator is on the front line managing these escalating costs—from food to energy—and trying to attract customers with less disposable income, their financial resources are capped at a fixed 20% of turnover. This structure effectively inverts the normal business risk model. Where a typical owner can mitigate rising costs by changing suppliers or adjusting pricing strategy, this agreement removes those levers. The operator is left to absorb inflationary shocks from a fixed-percentage income, placing the majority of the operational risk squarely on their shoulders while Marston’s retains 80% of the turnover. The agreement also removes a key tool for managing costs, as Clause 6.1 stipulates that the operator must purchase products exclusively from Marston’s, preventing them from seeking more competitive pricing elsewhere.

4. The Verdict: Who Should Sign and Who Should Walk Away?

4.1 Who This Deal Is For

Given the low upfront capital risk (Marston’s covers building insurance per Clause 4.2.6, and it’s recognized as a “low cost entry” model), this agreement may be suitable for a very specific type of operator. This would be a new entrant to the industry, a sole operator, or a couple who can provide the vast majority of the labour themselves. By personally covering the bar, kitchen, and hotel housekeeping, they would minimize the single largest cost—wages—that must come out of the 20% fee, potentially making the model viable for their specific circumstances.

4.2 Who Should Walk Away

This agreement should be avoided by experienced operators who value autonomy, entrepreneurs looking to build their own business equity, or anyone intending to hire and manage a full team of staff. The fixed 20% retainer makes covering a comprehensive wage bill extremely difficult. Furthermore, restrictive non-compete clauses (Clause 15.2) present a significant drawback for a career publican, preventing them from being involved in any similar business within a three-mile radius for twelve months after the agreement ends, effectively locking them out of the local industry.

5. Your Next Move

Don’t rely on guesswork. Run this lease through our specialist AI Trap Detector tool before you sign anything.