As a pub owner, you’re used to managing risks—dodgy barrels, staff who don’t show up on a Sunday morning, or a sudden hike in utility bills. But there is a silent, financial “landmine” buried in thousands of UK pub leases that has nothing to do with your cellar or your kitchen.

It’s three words long. And if they are in your contract, you aren’t just a tenant; you are an unpaid insurance policy for a multi-billion pound corporation.

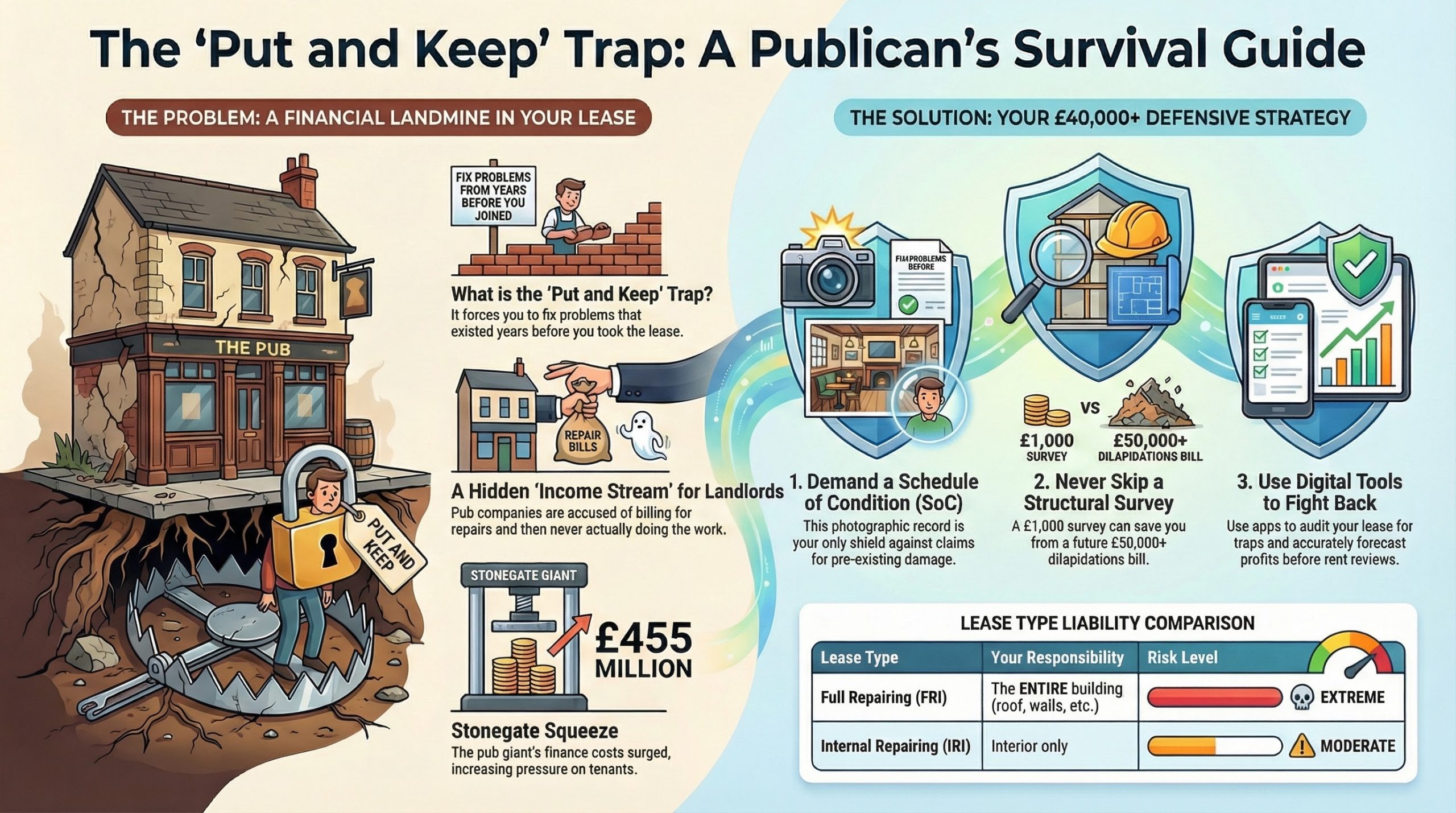

The words are: “Put and Keep.”

If your lease contains these words, you could be legally liable for repairs that were needed ten years before you ever picked up the keys. In an era where major pub-owning businesses (POBs) like Stonegate Group are reporting comprehensive losses of £160 million and facing surging finance costs of £455 million, these clauses are being used as a “weapon of choice” to squeeze cash out of publicans.

1. Anatomy of a Trap: What “Put and Keep” Really Means

Most tenants assume that “keeping a property in repair” means fixing things that break while they are there. That’s a fair, common-sense assumption. Unfortunately, English law doesn’t always follow common sense.

Established case law (such as Anstruther-Gough-Calthorpe v McOscar) dictates that an obligation to keep a property in repair includes an obligation to first put it into repair.

The Financial Reality

- The Inheritance: If the flooring was rotten or the roof was leaking the day you signed the lease, a “put and keep” clause makes it your contractual liability to fix it at your own cost.

- The FRI Standard: Most tied pub agreements are Full Repairing and Insuring (FRI) leases. This means you are responsible for the whole building—including structural elements like the walls and roof.

- The Yield Up: When your lease ends, you must “yield up” the property in the state required by the lease. If you haven’t “put” it right, the landlord will serve a Schedule of Dilapidations—a bill for every defect, even those that pre-date your tenure.

Expert Insight: Pub companies have been accused of using dilapidations as an “income stream” and a deterrent to stop tenants from pursuing the Market Rent Only (MRO) option. Where costs are charged to outgoing tenants, the work is often never actually done, meaning the next tenant inherits the same liability.

2. Why the “Stonegate Squeeze” is Happening Now

Why is this suddenly a crisis? Look at the numbers. The Stonegate Group’s 2024 Financial Statement reveals a company under immense pressure:

- Surging Debt Costs: Their interest payable on loan notes jumped from £235 million to £313 million in just one year.

- Total Losses: They recorded a loss for the period of £160 million.

- Asset Disposal: With such a high debt pile, many sites are being earmarked for sale or “revaluation”.

When a Pubco is losing money at this scale, they cannot afford to pay for roofs, car park resurfacing, or structural damp. In the latest PCA Tied Tenant Survey (2025), Stonegate remained at the “bottom of the league table” for satisfaction, with only 43% of tenants satisfied. Many of these dissatisfied publicans cite “maintenance and repair issues” and “broken promises” as the primary reason for the breakdown in their relationship.

3. The £40,000 Exit Defense: Your Practical Guide

If you are already in a lease, or considering a new one, you need a defensive strategy. You cannot rely on a “friendly chat” with your BDM. You need a paper trail.

Step 1: The Schedule of Condition (SoC)

The only way to limit a “put and keep” obligation is to have an agreed Schedule of Condition at the start of the tenancy. This document must be photographic and detailed. If your lease says you must return the pub in “no worse condition” than the SoC, you have a shield against pre-existing damage.

Step 2: The Structural Survey

Never sign a tied lease without an independent structural survey. Pubcos are required to advise you to do this, but many tenants skip it to save £1,000—only to be hit with a £50,000 dilapidations bill five years later.

Step 3: Use the Pubs Code Adjudicator (PCA)

The Pubs Code exists to ensure you are “no worse off” than if you were free-of-tie.

- Initial Works: Before you sign, the POB must provide a list of “Initial Works” they are aware of and state who is responsible for them.

- BDM Notes: Your BDM must make notes of any discussion regarding repairs and provide you with a copy within 14 days. If they don’t, they are in breach of the Code.

4. Comparing the Risk: FRI vs. IRI Leases

| Feature | Full Repairing (FRI) | Internal Repairing (IRI) |

| Responsibility | Whole building (Structure + Interior) | Interior only |

| Commonly Found In | Long-term tied leases | Short-term tenancies or “parts” of buildings |

| The Trap | You fix the roof, even if it’s 200 years old. | Landlord handles structure; you pay a service charge. |

| Risk Level | EXTREME | MODERATE |

5. The “Digital Union” Strategy for 2025

You are not alone in this. The “Digital Union” of publicans is using tech to fight back against corporate extraction.

- Stop Guessing Your Profits: Before you negotiate a rent review (which is often based on the Pubco’s inflated “Shadow P&L”), use the Sunday Roast Forecaster. It uses real-world data to show what your busiest day actually costs, so you can prove to your BDM that their rent assessment is based on “Ghost Profits”.

- Audit Your Lease: Use our Ultimate Pubs Code Law Assistant to scan your agreement for “Put and Keep” traps. We provide the “Fix It” letter templates you need to demand repairs from your landlord without spending £300/hour on a solicitor.

The Final Word

A pub is more than just a building; it’s a community. But to the accountants at TDR Capital or the Stonegate Group, it’s a line on a balance sheet. Don’t let a three-word clause in a 50-page contract take away everything you’ve worked for.