When your Business Development Manager (BDM) drops a Rent Assessment Proposal (RAP) on your bar, it usually looks like an impenetrable wall of spreadsheets. It’s designed that way. Behind the professional formatting is a Shadow Profit and Loss (P&L) account—a document that often contains more fiction than a paperback novel.

If you don’t know how to pick this document apart, you aren’t just paying rent on a building; you are paying a “success tax” on your own hard work.

1. The “Shadow P&L” Exposed

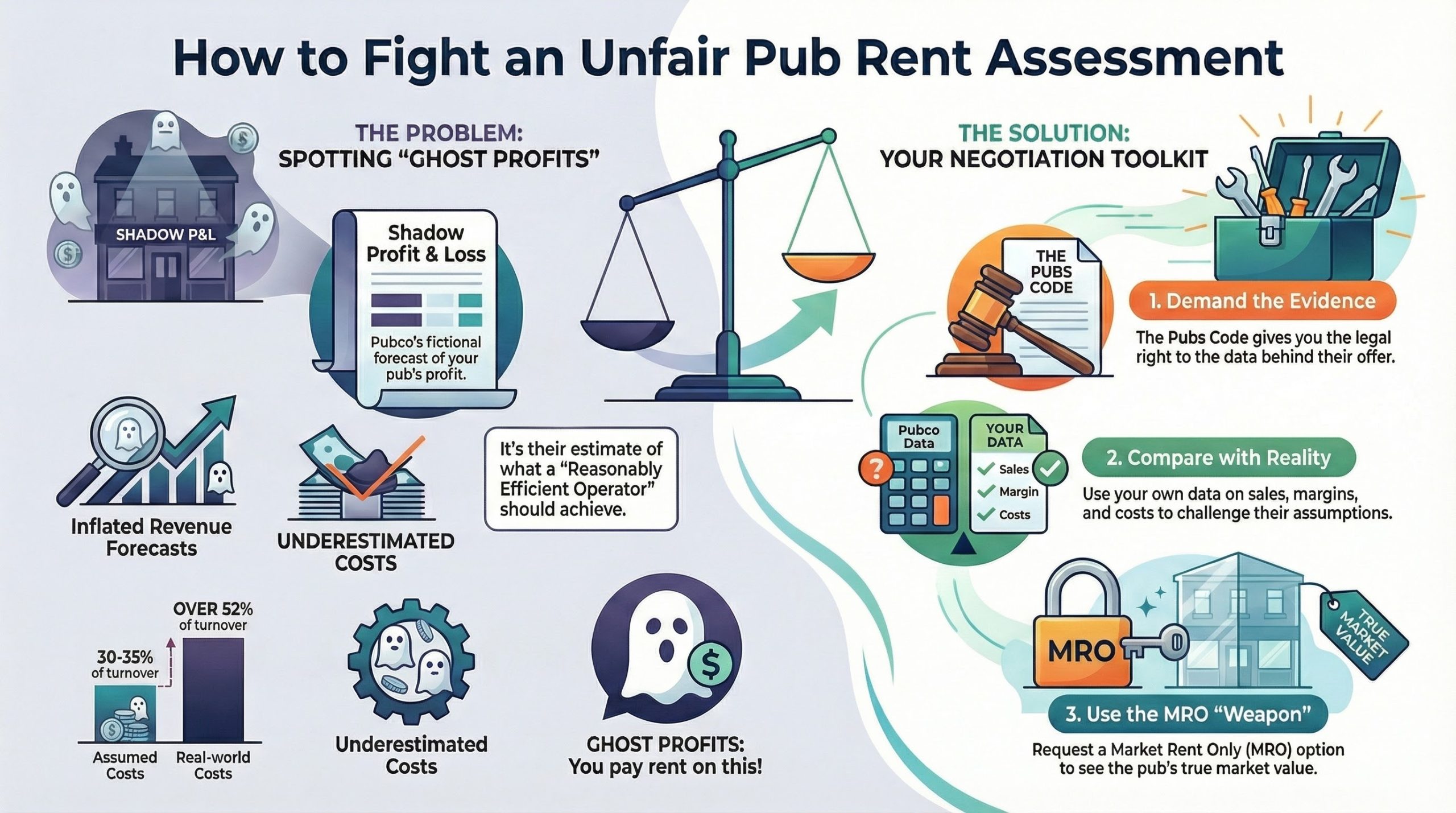

A Shadow P&L is the Pubco’s estimate of what a “Reasonably Efficient Operator” (REO) should be able to achieve in your pub. It outlines their assumptions for Fair Maintainable Trade (FMT), gross profits, and operating costs.

The problem? Pubcos often “fiddle” with these inputs to ensure the Divisible Balance (the profit left before rent) is as high as possible.

The Top 3 “Ghost Profit” Tactics:

- Inflated FMT: They estimate a “future potential” turnover that is far beyond what the pub has ever achieved.

- The Sales Mix Fiddle: They assume you sell more high-margin spirits and wine than lager to artificially boost your Gross Profit.

- Underestimated Costs: They often peg running costs at 30-35% of turnover, when real-world benchmarking shows they are frequently over 52%.

2. Goodwill Theft: Are You Being Rented Against Yourself?

This is the most “insane” part of the process. Under the Pubs Code and standard RICS guidance, a rent assessment should disregard Tenant’s Goodwill. The rent should be based on the property itself, not your 80-hour work weeks or your legendary Sunday Roasts.

If your BDM says, “Turnover is up, so the rent is going up,” they are essentially trying to steal your goodwill. You should challenge them to explain why the property—as an empty shell—is worth more today than it was five years ago.

3. How to Strike Back

You do not have to accept the first figure they give you. A rent review is a negotiation, not a decree.

- Request the Evidence: Under the Pubs Code, you have the right to receive the information and evidence used to justify their offer.

- Compare with Reality: Run your own figures. Are they underestimating wastage? Are they ignoring the 2025 hike in business rates or the £90,000 VAT threshold?.

- The MRO Weapon: If you are at a contractual rent review, you have the right to request a Market Rent Only (MRO) option. Even if you want to stay tied, getting an MRO quote is the best way to see the true “free-of-tie” market value of your pub.

Professional Advice: If you cannot reach an agreement, you can refer the dispute to the Pubs Independent Rent Review Scheme (PIRRS) or an Independent Assessor under the Pubs Code.

4. Data is Your Best Defense

BDMs rely on tenants not having their own data. Don’t be that tenant.

- Audit the Shadow P&L: Use our Ultimate Pubs Code Law Assistant to spot the “Ghost Profits” in your RAP. We help you draft the exact counter-proposals that force them to acknowledge real-world operating costs.

- Prove Your Margins: Use the Sunday Roast Forecaster to demonstrate exactly how much profit is being eaten up by inflation and staffing. If you can show your actual food margins are 10% lower than their “REO” assumption, you have the ammo to demand a lower rent.

The Final Word

The Pubco counts on your “brain value” to pay their “brick value” rent. By picking apart the Shadow P&L, you stop being a victim of their math and start being the authority in the room.