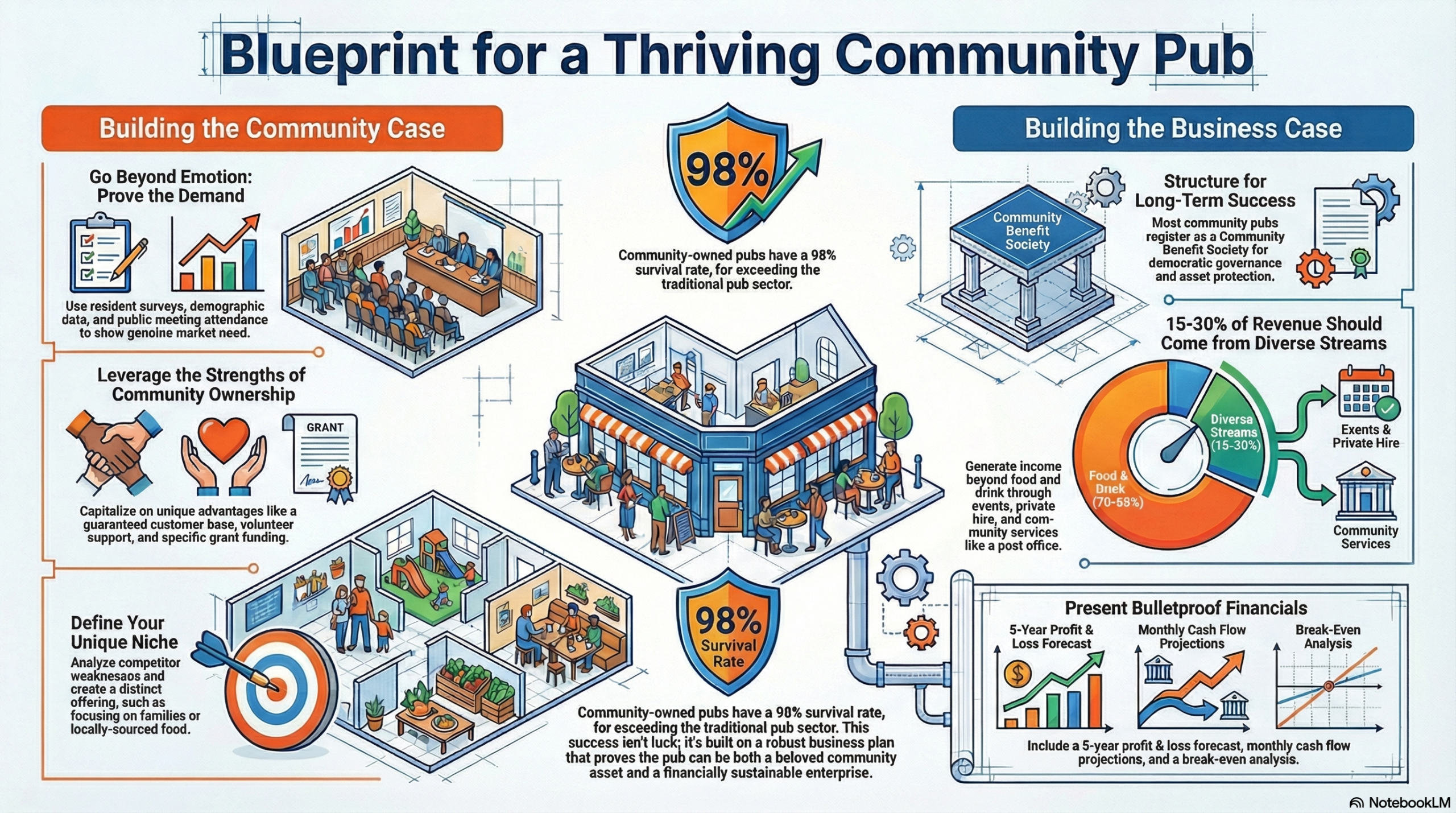

Community-owned pubs represent one of the most successful models in the UK hospitality sector. While traditional pubs close at an alarming rate, community pubs have a 98% survival rate after five years. That’s not luck—it’s the result of engaged ownership, clear planning, and communities rallying around venues they refuse to lose.

If you’re considering establishing a community pub or transforming an existing venue into community ownership, you need more than passion. You need a bulletproof business plan that satisfies investors, regulators, and most importantly, proves your pub can thrive financially.

This guide provides the complete framework for creating a community pub business plan that works. I’ll share the exact structure, financial projections, and strategic thinking that successful community pubs use, drawn from working with dozens of community-owned venues through SmartPubTools.

What Makes Community Pubs Different?

Before diving into business plan specifics, understand what defines a community pub and why it matters for your planning.

Community pubs are owned by members of the local community—typically structured as Community Benefit Societies under the Co-operative and Community Benefit Societies Act 2014. Rather than a single owner or corporate chain, you might have 200-500 shareholders who’ve invested £200-2,000 each.

This ownership structure creates unique advantages:

Guaranteed customer base: Your shareholders are invested financially and emotionally. They’ll visit regularly and bring friends.

Volunteer workforce: Community pubs successfully utilize skilled volunteers for specific tasks (bookkeeping, marketing, maintenance), reducing payroll costs by 15-25%.

Community resilience: When times get tough, community shareholders often increase support rather than abandon ship.

Local authority support: Councils and grant bodies favor community ownership, opening funding doors closed to commercial operators.

Asset of Community Value protection: Communities can nominate pubs as Assets of Community Value, giving them time to mount buyout bids when pubs face closure.

But community ownership also creates unique challenges that your business plan must address:

Democratic decision-making: Management committees and member votes can slow strategic pivots.

Diverse stakeholder expectations: Your shareholders range from retired teachers to young families—balancing their visions requires skill.

Volunteer coordination: Free labor isn’t free—managing volunteers takes time and systems.

Public accountability: You’re spending community money, which means heightened scrutiny and reporting requirements.

Your business plan must demonstrate you understand both the advantages and challenges, with concrete strategies for each.

Executive Summary: Making Your First Impression Count

The executive summary appears first but write it last. This 2-3 page section determines whether readers continue or bin your entire plan.

Include these specific elements:

The Opportunity Statement

What problem are you solving? Don’t write “the pub might close.” Instead: “High Greens has no social venue within 2 miles, isolating elderly residents and forcing families to travel for community gatherings. The Red Lion’s closure in 2023 eliminated the village’s last gathering place, and resident surveys show 78% would actively support a community pub.”

Quantify the problem and demonstrate genuine need backed by data.

Your Solution

Describe your community pub concept in 3-4 sentences. What will this venue be? A traditional village local? A food-focused gastropub? A family-friendly community hub?

Example: “The Red Lion Community Pub will reopen as a food-led venue serving locally-sourced British classics, offering evening dining Wednesday-Saturday and Sunday lunch. The venue will host community events, provide meeting space for local groups, and operate as the village post office partner, creating a sustainable multi-revenue model.”

Financial Snapshot

Present the essential numbers upfront:

- Total capital required: £XXX,XXX

- Share offer target: £XXX,XXX

- Grant funding secured/applied for: £XXX,XXX

- Projected year 1 revenue: £XXX,XXX

- Break-even timeline: Month XX

- Projected annual profit by year 3: £XX,XXX

Management Team

Briefly introduce your management committee and operational team. Highlight relevant experience: “Our management committee includes a retired bank manager (finance), a local restaurateur (F&B operations), and a former parish councillor (community engagement).”

Funding Request

State exactly what you’re asking for: “We are raising £350,000 through community shares at £200-10,000 per member, targeting 250-350 shareholders. This will fund property acquisition (£220,000), refurbishment (£80,000), and initial working capital (£50,000).”

Success Metrics

Define what success looks like in year 1, 3, and 5. Include both financial and community metrics: “By year 3, we will achieve £420,000 annual turnover, employ 8 staff, host 12 community groups weekly, and pay our first dividend to shareholders.”

Market Analysis: Proving Demand for Your Community Pub

Investors—even community investors—need proof people will actually spend money at your venue. Emotional attachment to the local pub isn’t enough; demonstrate genuine commercial viability.

Demographic Analysis

Profile your catchment area in detail:

- Population within 1 mile, 3 miles, 5 miles

- Age distribution (particularly 25-65 year-olds with disposable income)

- Household income levels

- Housing mix (families, retirees, young professionals)

- Population trends (growing, stable, declining)

Use Office for National Statistics data, local council planning documents, and census information. Be specific: “Our 3-mile catchment contains 8,200 residents with median household income of £42,000, 18% above the national average. Recent housing developments added 340 homes in the past 3 years, with 180 more approved.”

Community Needs Assessment

Present evidence of community demand through:

Resident surveys: “We surveyed 380 local residents (23% response rate). Results showed 76% would visit monthly, 34% would visit weekly, and average projected spend was £28 per visit.”

Public meetings attendance: “Our initial community meeting attracted 120 residents, with 78 expressing immediate interest in purchasing shares.”

Petitions and support letters: “Our save-the-pub petition gathered 650 signatures from verified local residents.”

Loss impact statements: Document what the community lost when the pub closed—social isolation, loss of meeting space, reduced emergency services presence (if it housed a defibrillator), economic impact on local suppliers.

Competitor Analysis

Identify all food and drink venues within your catchment area. For each, note:

- Distance from your location

- Price positioning

- Food offering

- Atmosphere and target demographic

- Strengths and weaknesses

Then explain how you’ll differentiate. Don’t claim there’s “no competition”—savvy investors know that’s never true. Instead: “The nearest pub is 2.3 miles away and targets drinkers over 50 with basic bar snacks. We will focus on food-led dining for families and couples aged 30-60, creating a distinct market position.

Market Trends and Opportunities

Demonstrate awareness of broader hospitality trends:

- Growth in locally-sourced food demand

- Shift toward community spaces post-COVID

- Increasing alcohol-free and low-alcohol options

- Demand for flexible co-working spaces in rural areas

- Rise of “third places” for social connection

Explain how your community pub will capitalize on these trends rather than fight against them.

Organizational Structure and Management

Community pubs require more complex governance than commercial operations. Your business plan must show you understand these structures and have the right people in place.

Legal Structure

Most community pubs register as Community Benefit Societies (BenComs) under the Co-operative and Community Benefit Societies Act 2014. Explain why this structure suits your venture:

“We will register as a Community Benefit Society, providing:

- Limited liability for members

- Ability to raise capital through community shares

- Democratic governance (one member, one vote)

- Asset lock ensuring the pub remains community-owned

- Tax advantages including Business Rates relief eligibility”

Detail your society rules, share structure (minimum/maximum investment), and withdrawal terms.

Governance Structure

Outline your management committee composition:

- Number of committee members (typically 7-12)

- Election process and terms

- Committee roles (Chair, Treasurer, Secretary, etc.)

- Meeting frequency

- Decision-making processes

Include brief bios of founding committee members, emphasizing relevant expertise.

Operational Management

Distinguish between governance (volunteer committee) and operations (paid staff):

“Day-to-day operations will be managed by an experienced General Manager (salary: £32,000-38,000) reporting to the Management Committee. The GM will oversee:

- 2 full-time kitchen staff

- 1 full-time bar manager

- 4-6 part-time bar and waiting staff

- Volunteer coordinators”

Volunteer Management Plan

Successful community pubs integrate volunteers strategically without exploiting free labor:

Appropriate volunteer roles:

- Maintenance and gardening

- Event organization

- Marketing and social media

- Bookkeeping support (qualified members)

- Community outreach

Paid staff roles (never volunteers):

- Food preparation and service

- Bar service during trading hours

- Cleaning and hygiene

- Cash handling and management

Include your volunteer recruitment, training, and recognition systems. Explain how you’ll maintain volunteer enthusiasm beyond the initial excitement.

Professional Advisors

List your professional support team:

- Legal advisor (society setup, licensing)

- Accountant (bookkeeping, tax compliance)

- Business mentor or consultant

- Commercial insurance broker

- Architect/surveyor (for refurbishment)

Service Offering: What You’ll Provide

Define your revenue-generating activities in detail. Community pubs often diversify beyond traditional pub offerings to ensure financial sustainability.

Food and Beverage Offering

Menu Concept: Describe your food philosophy, price points, and service style. “British classics using locally-sourced ingredients, with mains priced £12-18. Table service for food; bar service for drinks.”

Beverage Range: Detail your drinks offer—cask ales, craft beer selection, wine list, soft drinks, coffee. Mention local breweries or suppliers you’ll partner with.

Service Times: Specify trading hours for each day, noting different service styles (lunch vs. dinner, weekend brunch).

Community Services

What non-commercial services will you provide?

Meeting Space: “Free or low-cost room hire for community groups, charities, and clubs during off-peak hours (Monday-Tuesday afternoons).”

Post Office or Shop: “Partnership with Post Office Local service, generating £8,000-12,000 annual commission while increasing footfall.”

Information Hub: Notice boards, tourist information, local event promotion.

Employment and Training: “Two apprenticeships offered annually in partnership with local colleges.”

Events and Entertainment

Detail your events calendar:

- Regular weekly events (quiz nights, live music, craft groups)

- Monthly special events (themed dinners, meet-the-brewer, community celebrations)

- Annual signature events (beer festival, Christmas market, summer fete)

Estimate attendance and revenue for each event type.

Additional Revenue Streams

Successful community pubs often generate 15-30% of revenue from non-traditional sources:

Private Hire: Wedding receptions, birthday parties, business meetings, funeral wakes.

Takeaway Service: Food and drink sales for home consumption.

Accommodation: If your property includes rooms, B&B provision can significantly boost revenue.

Retail: Local produce, branded merchandise, gift items.

External Catering: Providing food for local events and functions.

For each revenue stream, provide realistic projections based on comparable venues or market research.

Marketing and Customer Engagement Strategy

Community pubs have built-in marketing advantages—your shareholders are your brand ambassadors. But you still need professional marketing to attract visitors beyond your immediate membership.

Target Customer Segments

Define 3-5 primary customer segments:

Segment 1: Local Residents (40% of revenue)

- Demographics: Families and couples aged 30-60, living within 2 miles

- Frequency: 2-3 visits per month

- Average spend: £32 per visit

- Motivation: Convenience, supporting community ownership, quality food

Segment 2: Destination Diners (30% of revenue)

- Demographics: Couples aged 40-70, travelling 5-15 miles

- Frequency: Monthly special occasions

- Average spend: £55 per visit

- Motivation: Food quality, unique venue, countryside setting

Segment 3: Community Groups (15% of revenue)

- Demographics: Clubs, societies, and organizations (20+ members each)

- Frequency: Weekly or fortnightly meetings

- Average spend: £8-12 per person

- Motivation: Affordable meeting space, supporting community asset

Continue for remaining segments (tourists, business travelers, etc.).

Brand Positioning

How will you position your community pub in customers’ minds?

“The Red Lion positions as ‘Your village, your pub’—a welcoming community hub where excellent food happens to be served, rather than a restaurant that happens to have a bar. We emphasize authenticity, local connections, and inclusive atmosphere over pretension.”

Marketing Channels and Tactics

Detail your marketing approach across multiple channels:

Digital Marketing:

- Website: Functions, content strategy, booking systems

- Social Media: Primary platforms (Facebook for events, Instagram for food photography), posting frequency, content themes

- Email Marketing: Newsletter schedule, segmentation strategy, automation for event promotion

- Google Business Profile: Review management, post updates, local SEO optimization

Traditional Marketing:

- Local press: Monthly stories highlighting community impact, events, and achievements

- Parish magazines and notice boards

- Direct mail: Event flyers and seasonal menu launches

- Partnerships: Cross-promotion with local businesses and attractions

Word-of-Mouth Amplification:

- Shareholder communications: Monthly updates creating ambassadors

- Referral incentives: “Bring a friend” promotions

- Community event sponsorships: Visibility at local fetes, sports matches, school events

Marketing Technology and Automation:

This is where many community pubs struggle. With limited staff and volunteer marketing teams, maintaining consistent, timely promotion is challenging.

Modern marketing tools help community pubs compete professionally without massive budgets. For example, SmartPubTools provides AI-powered marketing automation specifically designed for UK pubs, helping community venues:

- Create event promotion sequences automatically

- Generate social media content aligned with your community values

- Track local sports fixtures and weather for timely promotions

- Maintain consistent messaging across all channels

Effective marketing technology ensures your volunteer marketing team isn’t overwhelmed while maintaining professional standards.

Customer Retention Strategy

Acquiring customers costs 5-7 times more than retaining them. Detail your loyalty approach:

Membership Benefits: Even non-shareholders can join a “friends” scheme with benefits like priority booking, exclusive events, and discounts.

Birthday and Anniversary Recognition: Automated communications and special offers.

Feedback Systems: Regular surveys, suggestion schemes, and visible action on community input.

Seasonal Campaign Calendar: Pre-planned marketing for key trading periods (Easter, summer, Christmas) rather than reactive scrambling.

Financial Projections and Analysis

This section makes or breaks your business plan. Investors need credible numbers demonstrating your community pub can survive and eventually thrive.

Capital Requirements and Funding Sources

Present a detailed breakdown of all startup costs:

Property Acquisition: £XXX,XXX

- Purchase price or lease premium

- Legal fees

- Survey and valuation costs

- Stamp duty (if applicable)

Refurbishment and Equipment: £XXX,XXX

- Kitchen equipment: £XX,XXX

- Bar equipment and cellar: £XX,XXX

- Furniture and fixtures: £XX,XXX

- Decoration and repairs: £XX,XXX

- IT systems and tills: £X,XXX

- Signage: £X,XXX

Pre-Opening Costs: £XX,XXX

- Licenses and permits: £X,XXX

- Initial stock: £X,XXX

- Insurance: £X,XXX

- Marketing launch campaign: £X,XXX

- Staff recruitment and training: £X,XXX

- Professional fees (legal, accounting): £X,XXX

Working Capital: £XX,XXX

- Three months operating expenses: £XX,XXX

- Contingency reserve (10-15%): £XX,XXX

Total Capital Requirement: £XXX,XXX

Then detail your funding sources:

Community Share Offer: £XXX,XXX

- Target: XXX shareholders

- Minimum investment: £XXX

- Maximum investment: £X,XXX

Grant Funding: £XX,XXX

- More Than a Pub programme: £XX,XXX (confirmed/applied)

- Local authority community grant: £XX,XXX (confirmed/applied)

- Power to Change: £XX,XXX (applied)

- Other grants: £XX,XXX

Community Fundraising: £XX,XXX

- Events and donations

Loan Finance: £XX,XXX (if applicable)

- Community Shares Booster Programme

- Social investment

- Commercial loan

Revenue Projections

Create detailed monthly projections for Year 1, then annual for Years 2-5. Base projections on:

- Comparable venue data

- Realistic covers and average transaction values

- Seasonal variations

- Trading hour limitations

Revenue Breakdown Example (Year 1):

Wet Sales (beverages): £125,000 (42%)

- Cask ale: £32,000

- Lager and cider: £38,000

- Wine: £28,000

- Spirits: £18,000

- Soft drinks and coffee: £9,000

Dry Sales (food): £155,000 (52%)

- Lunch service: £52,000

- Evening dining: £78,000

- Sunday roasts: £25,000

Other Revenue: £18,000 (6%)

- Private hire: £8,000

- Events: £5,000

- Post office commission: £3,000

- Retail: £2,000

Total Year 1 Revenue: £298,000

Provide clear assumptions: “Projections based on 60 covers weekly for evening service, £22 average transaction value, with 30% ramp-up over first 6 months as community awareness builds.”

Cost of Sales and Gross Profit

Detail your margin expectations:

Wet Sales Gross Margin: 55-60%

- Cask ale: 60%

- Lager: 55%

- Wine: 58%

- Spirits: 65%

Dry Sales Gross Margin: 65-70%

- Achievable with good supplier relationships and menu engineering

Year 1 Total Gross Profit: £XXX,XXX (XX% gross margin)

Explain how you’ll achieve these margins: local supplier partnerships, proper portion control, menu design, waste management.

Operating Expenses

List all fixed and variable costs:

Payroll (typically 30-35% of revenue):

- General Manager: £XX,XXX

- Kitchen staff: £XX,XXX

- Bar and waiting staff: £XX,XXX

- Payroll taxes and pension: £XX,XXX

Premises Costs:

- Rent or mortgage: £XX,XXX

- Business rates: £XX,XXX

- Buildings insurance: £X,XXX

- Utilities (gas, electric, water): £XX,XXX

- Maintenance and repairs: £X,XXX

Operating Costs:

- Marketing: £X,XXX

- Professional fees (accounting, legal): £X,XXX

- Licenses and subscriptions: £X,XXX

- Cleaning supplies: £X,XXX

- POS and technology: £X,XXX

- Telephone and internet: £X,XXX

- Waste disposal: £X,XXX

Total Operating Expenses Year 1: £XXX,XXX

Profit and Loss Projection

Present a clear 5-year P&L summary:

YearRevenueCOGSGross ProfitOperating ExpensesEBITDANet Profit1£298K£95K£203K (68%)£195K£8K£5K2£365K£115K£250K (68%)£225K£25K£18K3£420K£132K£288K (69%)£248K£40K£32K4£445K£139K£306K (69%)£258K£48K£40K5£468K£146K£322K (69%)£268K£54K£46K

Explain your growth assumptions and when you expect to reach sustainable profitability.

Cash Flow Projections

Cash flow kills more businesses than profitability issues. Show monthly cash flow for Year 1, highlighting:

- Opening cash balance

- Cash receipts (sales, share offer proceeds, grants)

- Cash payments (suppliers, payroll, overheads, capital expenditures)

- Net cash flow

- Closing cash balance

Identify any cash flow pinch points and how you’ll manage them: “December-February typically shows reduced revenue. We will maintain £30,000 working capital reserve and coordinate major capital expenses during high-revenue summer months.”

Break-Even Analysis

Calculate your monthly break-even point: “With fixed costs of £XX,XXX monthly and 68% gross margin, we require £XX,XXX monthly revenue to break even. Based on projections, we will reach break-even in Month X.”

Sensitivity Analysis

Demonstrate what happens if assumptions vary:

- Revenue 10% below projections

- Revenue 20% below projections

- COGS 5% higher than expected

- Key staff member departure requiring temporary agency cover

Show you’ve planned for challenges: “Even with revenue 15% below Year 1 projections, we remain cash-flow positive due to our £30,000 working capital reserve and ability to reduce discretionary spending.”

Return on Investment for Shareholders

Community share investments aren’t typical commercial investments, but members still want to understand potential returns:

“Based on our projections, we anticipate paying initial dividends from Year 3 onwards at 2-4% annually. Our focus remains on sustainability and community benefit rather than maximizing shareholder returns, with profits reinvested in venue improvements and community programs.”

Be realistic—most community pubs pay modest dividends (if any) for the first 3-5 years, prioritizing stability over returns.

Risk Analysis and Mitigation

Acknowledge potential risks and explain your mitigation strategies. This demonstrates maturity and preparedness.

Financial Risks

Risk: Revenue falls short of projections Mitigation: Conservative Year 1 assumptions (30% ramp-up period), working capital reserve, ability to reduce variable costs quickly, contingency funding from management committee members

Risk: Unexpected capital expenditure (equipment failure, building repairs) Mitigation: Comprehensive maintenance programme, equipment warranties, capital reserve fund (3-5% of revenue annually)

Risk: Grant funding applications unsuccessful Mitigation: Community share offer sized to cover essential costs independently, grants treated as bonus funding for enhancements rather than essential operations

Operational Risks

Risk: Difficulty recruiting or retaining quality staff Mitigation: Competitive wage rates, positive working environment, training and development opportunities, good relationship with local hospitality recruitment networks

Risk: Food safety or licensing violations Mitigation: Experienced management with licensing and food hygiene qualifications, regular training, documented procedures, compliance calendar, relationship with Environmental Health

Risk: Volunteer enthusiasm wanes after launch excitement Mitigation: Structured volunteer programme, recognition systems, rotating responsibilities, social events for volunteers, clear communication of impact

Market Risks

Risk: Competitor opens nearby or existing competitor improves offering Mitigation: Strong community ownership creates loyalty advantage, regular customer feedback ensures we adapt quickly, our food quality and service remains priority

Risk: Broader economic downturn reduces discretionary spending Mitigation: Community pubs prove resilient in recessions due to emotional investment from shareholders, value-focused menu options, flexible pricing strategies

Reputational Risks

Risk: Social media crisis or negative review impacts reputation Mitigation: Social media policy and monitoring, rapid response procedures, transparent communication, service recovery training for staff

Risk: Committee disputes become public and damage confidence Mitigation: Clear governance procedures, conflict resolution protocols, external mediation available, regular governance training

For each risk, rate its likelihood (low/medium/high) and potential impact, showing you’ve genuinely analyzed vulnerabilities.

Milestones and Implementation Timeline

Present a realistic timeline from business plan completion to profitable operations:

Pre-Launch Phase (Months 1-6)

Month 1-2: Legal and Financial Setup

- Register Community Benefit Society

- Open business bank account

- Engage legal and accounting advisors

- Finalize society rules and share offer document

- Obtain FSA approval for share offer

Month 3-4: Fundraising Campaign

- Launch community share offer

- Public meetings and information sessions

- Grant applications submitted

- Shareholder communications and updates

Month 5-6: Property and Licensing

- Property purchase or lease completion

- Apply for premises license and other permits

- Commission building survey and refurbishment plans

- Tender for refurbishment work

Launch Phase (Months 7-12)

Month 7-9: Refurbishment

- Construction and decoration work

- Kitchen and bar installation

- Furniture, fixtures, and equipment

- IT systems and POS installation

- Signage and external improvements

Month 10-11: Pre-Opening Preparation

- Staff recruitment and training

- Supplier agreements and initial stock orders

- Soft launch and trial services

- Marketing campaign and local press

- Health and safety inspections

Month 12: Grand Opening

- Official opening event

- First month trading

- Feedback collection and rapid adjustments

Growth Phase (Years 1-3)

Year 1: Establishment

- Achieve consistent service standards

- Build regular customer base

- Establish event calendar

- Reach break-even point

- Complete first AGM and annual report to members

Year 2: Optimization

- Refine menu based on customer preferences

- Expand events programme

- Increase revenue per customer

- Achieve sustainable profitability

- Begin capital reserve fund

Year 3: Maturity

- Consider expansion of services (accommodation, external catering)

- Pay first shareholder dividends (if profitable)

- Establish succession planning for key roles

- Support other community pub initiatives

Measuring Success: KPIs and Reporting

Define how you’ll measure and communicate success to your community shareholders.

Financial KPIs

- Monthly revenue vs. budget

- Gross profit margin by category

- Labor cost percentage

- Cash reserves

- Break-even achievement date

- Annual profit/loss

Operational KPIs

- Customer covers (daily, weekly, monthly)

- Average transaction value

- Food cost percentage

- Staff retention rate

- Health and safety compliance record

Community Impact KPIs

- Number of active shareholders

- Community groups using venue

- Volunteer hours contributed

- Local suppliers engaged

- Employment created (FTE)

- Community events hosted

Reporting Cadence

Monthly: Management committee receives financial dashboard and operational report

Quarterly: Newsletter to all shareholders with financial summary, achievements, and upcoming plans

Annually: Comprehensive annual report, AGM presentation, and financial accounts

Transparent, regular communication builds trust and maintains engagement—essential for community ownership success.

Legal and Regulatory Compliance

Community pubs must navigate the same hospitality regulations as commercial venues, plus additional requirements for community ownership.

Premises License

Detail your licensing needs:

- Sale of alcohol (on and off premises)

- Regulated entertainment (live music, DJ, recorded music, films)

- Late-night refreshment (hot food after 11pm)

- Operating hours for each activity

Other Key Licenses and Registrations

- Food hygiene rating and registration

- Entertainment licenses (PRS, PPL)

- TV license for showing broadcasts

- Gambling licenses (if hosting poker nights, raffles)

- Fire safety compliance and inspections

- Gas and electrical safety certificates

Employment Law Compliance

- PAYE registration

- Workplace pension scheme

- Employment contracts and staff handbook

- Health and safety policies

- DBS checks where appropriate

Community Benefit Society Compliance

- Annual return to Financial Conduct Authority

- Maintenance of members register

- AGM requirements (notice periods, quorum, voting)

- Rule changes requiring member approval

- Financial audit or independent examination

Data Protection and GDPR

- Privacy policy for customer and member data

- Consent management for marketing communications

- Data security measures

- Right to access and deletion procedures

Include a compliance calendar in your appendix showing when each requirement must be addressed—nothing kills community confidence faster than regulatory violations.

Support and Resources for Community Pubs

You’re not alone in this journey. Reference the support network available:

Plunkett Foundation

The UK’s leading organization supporting community ownership of pubs, shops, and other amenities. Provides:

- Free guidance and resources

- Business planning templates specific to community pubs

- “More Than a Pub” grant programme (up to £100,000)

- Regional advisors offering one-to-one support

- National network of community pub owners

The Pub is The Hub

Supports rural pubs diversifying into community services like post offices, shops, and facilities for community groups.

Power to Change

Community business funding organization offering grants and support for community-owned enterprises.

Locality

National membership network for community organizations, offering legal, governance, and financial advice.

Local Support

- Local authority economic development teams

- Community development finance institutions

- CAMRA branches (particularly for real ale focused pubs)

- Local business networks and chambers of commerce

Reference these in your plan to demonstrate awareness of the support ecosystem and your intention to utilize available resources.

Technology and Systems for Modern Community Pubs

Successful community pubs balance traditional values with modern operational efficiency. Your business plan should address technology investments.

Essential Systems

Point of Sale (POS): Cloud-based systems allowing real-time reporting, inventory tracking, and integration with accounting software. Budget: £3,000-6,000 initial setup plus £80-150 monthly subscription.

Accounting Software: Xero, QuickBooks, or similar for real-time financial visibility. Essential for volunteer treasurers managing complexity.

Booking Systems: Online table reservations and private hire management. Reduces staff phone time and improves customer experience.

Stock Management: Integration between POS and stock systems for automatic par-level tracking and ordering.

Marketing Technology

This is where many community pubs fall short. Volunteer marketing committees struggle with:

- Consistent social media posting

- Timely event promotion

- Seasonal campaign planning

- Content creation at scale

- Compliance with licensing and advertising regulations

Modern marketing platforms designed specifically for hospitality can transform this challenge. SmartPubTools, for example, provides AI-powered marketing automation that:

- Generates social media content aligned with your community values

- Creates event promotion sequences automatically

- Tracks local sports fixtures and weather patterns for timely campaigns

- Maintains professional standards without overwhelming volunteers

- Ensures Pubs Code and advertising compliance through built-in guidance

The right marketing technology multiplies your volunteer team’s effectiveness without requiring specialized skills, allowing them to focus on strategy and community relationships rather than daily posting schedules.

Communication Tools

Member Communications: Email platforms (Mailchimp, dotdigital) for shareholder updates, event invitations, and annual reports.

Internal Collaboration: Slack, Microsoft Teams, or similar for management committee and volunteer coordination.

Survey Tools: Regular feedback collection through Google Forms, SurveyMonkey, or similar.

Budget £200-400 monthly for comprehensive technology stack—expensive yes, but essential for professional operations competing with commercial venues.

Conclusion: Your Community Pub Journey Begins Here

A comprehensive business plan transforms community enthusiasm into commercial reality. This document serves multiple purposes:

Fundraising tool: Demonstrates to potential shareholders that you’re serious, professional, and have thought through the challenges.

Roadmap: Provides your management committee and operational team with clear direction and measurable milestones.

Risk management: Forces you to identify and plan for potential challenges before they become crises.

Communication vehicle: Keeps shareholders informed and engaged through regular reporting against plan.

The most successful community pubs I’ve worked with share one characteristic: they treated business planning not as a box-ticking exercise but as a genuine strategic process. They revisited and updated their plans quarterly, adapted when reality differed from projections, and remained ruthlessly honest about what was working and what wasn’t.

Your community deserves a pub that survives and thrives, not one that limps along on goodwill until inevitable closure. That requires business discipline alongside community passion.

Getting Professional Help with Your Community Pub Business Plan

Creating a comprehensive business plan is challenging, especially when you’re juggling committee meetings, fundraising, and community engagement. Professional support accelerates the process and improves quality.

SmartPubTools helps UK pub landlords—including community-owned venues—with strategic planning, marketing implementation, and operational excellence. Our Pubs Code Law Assistant provides guidance on regulatory compliance, licensing, and governance issues specific to community pubs.

Whether you’re developing your initial business plan, seeking guidance on legal structures, or need help implementing marketing systems that volunteer teams can actually manage, SmartPubTools provides the expertise and technology purpose-built for UK pub operations.

Visit SmartPubTools to see how we support community pubs in transforming their plans into profitable, sustainable reality.

Get your business plan together

About the Author: Shaun manages Teal Farm Pub in Washington, Tyne and Wear, and created SmartPubTools to help pub landlords implement effective operational and marketing strategies. He works with community pubs across the UK, helping them navigate the unique challenges of community ownership while achieving commercial success.

Ready to start your community pub journey? Begin with a solid business plan that addresses financial realities alongside community passion. The structure provided here has helped dozens of community pubs secure funding, open successfully, and build sustainable operations that serve their communities for decades to come.