The local pub holds a familiar, comforting place in our culture—a simple hub for community and conversation. But behind the polished brass and familiar chatter, this cherished institution is being reshaped by a brutal convergence of global finance, digital disruption, and immense social pressure. From crippling debt loads and regulatory tsunamis to AI-driven sales strategies and a surprising boom in premium beer, the world of pubs and brewing is undergoing a radical transformation. This article uncovers five of the most impactful and counter-intuitive trends shaping the industry today, revealing a complex reality far beyond a simple pint.

Star Pubs vs. Stonegate: The “Brewer vs. Banker” War (2025 Guide)

Date: December 2024 | Topic: Pub Tenancies & Operator Models

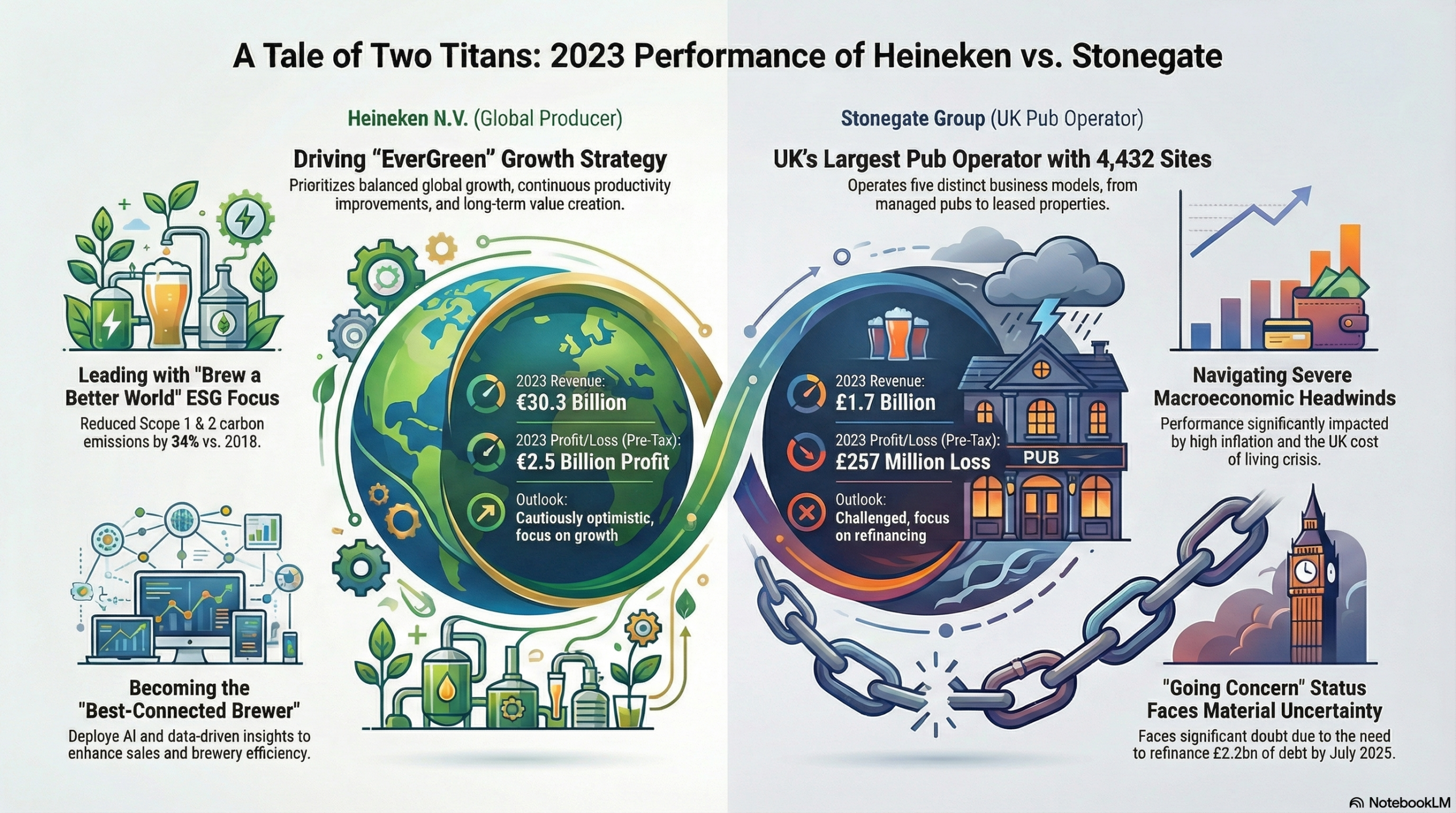

If you are considering taking on a pub tenancy in the UK in 2025, the choice often boils down to two giants: Star Pubs & Bars (owned by Heineken) and Stonegate Group (owned by TDR Capital). While their brochures may look similar, the financial reality behind them is vastly different. This is the “Brewer vs. Banker” war.

1. Financial Stability: Follow the Money

The stability of your landlord determines whether they will fix your roof or sell your pub.

Star Pubs & Bars (The Brewer)

- Backing: Heineken UK (Global Brewing Giant).

- Strategy: They are pouring money in. In 2025, Heineken announced a £40 million investment into their estate.

- Why? A closed pub sells no beer. Their priority is volume.

- Tenant Satisfaction: Rated “Most Improved” by the Pubs Code Adjudicator (PCA), rising to 70% satisfaction.

Stonegate Group (The Banker)

- Backing: TDR Capital (Private Equity).

- Strategy: They are trying to pull money out. The group manages a massive debt pile estimated at over £2.2 billion.

- Risk: In 2024, “going concern” warnings were issued regarding refinancing. They are actively selling off “Platinum” sites to pay down debt.

- Tenant Satisfaction: Consistently lower in PCA rankings (approx. 43-47%).

2. Managed Operator Models: Just Add Talent vs. Craft Union

Both companies offer a “Fake Manager” model—you are self-employed but run a managed house. Here is how the numbers stack up.

| Feature | Star Pubs (Just Add Talent) | Stonegate (Craft Union) |

|---|---|---|

| Entry Cost | ~£4,000 | ~£3,000 |

| Operator Cut | 20-30% Turnover + Profit Share | 18-20% Turnover |

| Utility Bills | Paid by Star (Inflation Shield) | Varies / Tighter Controls |

| Primary Risk | Brand Restrictions | High Volume Targets |

3. The Tied Lease Battle: Product vs. Price

If you prefer a traditional tenancy, understand the trap you are walking into.

Star Pubs: The “Heineken Handcuff”

The downside is the product tie. You are locked into Heineken brands (Moretti, Amstel, Cruzcampo). Obtaining a guest ale provision for a local craft IPA can be difficult or expensive. However, you benefit from massive national marketing campaigns because your landlord owns the brands.

Stonegate: The “Price Gouge”

Stonegate is a middleman. They buy beer from brewers and sell it to you. To make a profit, they must add a margin on top. This often results in a tied price list significantly higher than the open market. Additionally, “Dilapidations” (exit repair bills) remain the #1 complaint for Stonegate tenants.

4. The Verdict: Which Avatar Are You?

The “Brand Ambassador” (Choose Star)

You want a shiny, well-invested pub. You are happy to sell mainstream lager (Moretti/Heineken) and want a landlord with deep pockets who pays for the big repairs. You value stability over total independence.

The “Distressed Asset Hunter” (Choose Stonegate)

You are a gambler looking for a cheap entry point. You know Stonegate is under pressure to reduce debt, so you look for sites they are desperate to offload or lease. You might negotiate a rent-free period, but you accept the risk that your landlord is financially squeezed.

Disclaimer: This article is based on 2024/25 industry data, PCA reports, and corporate accounts. Always seek independent financial advice before signing a pub lease.

——————————————————————————–

1. The UK’s Biggest Pub Landlord Is Mortgaging Its Crown Jewels to Survive

The immense financial pressure on the UK pub sector is best understood through the predicament of its largest player, Stonegate Group. A behemoth with 4,432 sites, Stonegate is struggling under a staggering £3 billion debt burden, a legacy of its massive 2019 merger with rival Ei Group which left the company exceptionally vulnerable just months before the COVID-19 pandemic shattered the hospitality sector. To address this, the company has committed to a drastic plan: moving over 1,000 of its most profitable freehold properties—often described as its “platinum” pubs—out of its main financing group to raise £638 million in new debt against them.

This is not an isolated case of financial distress. A joint industry survey highlights the sector’s vulnerability, showing that over a third (35%) of UK hospitality businesses were at risk of being unviable or operating at a loss. These businesses are being crushed by soaring operational costs, with 96% of operators affected by higher energy prices and 93% by food price inflation. This move signals a potential future where even the most iconic pub portfolios are dismantled to service legacy debt, fundamentally altering the landscape of British hospitality.

——————————————————————————–

2. Your Local Isn’t Just Fighting Inflation, It’s Bracing for a Regulatory Tsunami

Beyond the well-publicized economic challenges, the UK hospitality industry is bracing for a wave of new and complex regulations that will add significant administrative and cost burdens. Businesses already struggling with tight margins must now prepare for a raft of new legal duties.

Among the most impactful upcoming regulations are:

• Martyn’s Law: Officially the Terrorism (Protection of Premises) Bill, this legislation will require venues to conduct enhanced risk assessments and implement new training protocols to protect the public from terrorist attacks.

• Deposit Return Scheme (DRS): This initiative is designed to increase recycling rates for single-use drinks containers. It will create new operational processes for businesses, which will have to manage the collection and return of these items.

• Scottish Pubs Code: Expected in 2025, these new regulations in Scotland will fundamentally alter the relationship between pub-owning businesses and their tenants, with potential ripple effects expected in England and Wales.

The key challenge is not one single rule, but the cumulative effect of all these changes landing on businesses that are already fighting for survival. For the 35% of businesses already operating at a loss, this cascade of new compliance duties represents not just an administrative headache, but a potential breaking point.

——————————————————————————–

3. The World’s Biggest Brewers Are Becoming Tech Companies

The traditional image of a brewer focused solely on hops and barley is rapidly becoming outdated. Behind global giants like Heineken lies a sophisticated, high-tech operation that more closely resembles a tech company.

Heineken has aggressively pursued a digital-first approach, most notably through its business-to-business (eB2B) platform, eazle. By the end of 2023, these digital platforms had captured nearly €11 billion in gross merchandise value by connecting the company with 700,000 active customers in fragmented, traditional channels like bars, restaurants, and small independent stores.

Heineken is also weaponizing Artificial Intelligence at a massive scale. Its AI application, AIDDA, is now active in five markets, providing data-driven advice to sales teams for over 200,000 customers. AIDDA generates tailored product recommendations, predicts which customers are likely to leave (customer churn), and even suggests the most efficient sales routes for representatives. This demonstrates that success in the modern beverage industry is as much about data science and digital logistics as it is about the art of brewing. This shift redefines the competitive moat in the industry, suggesting that the most successful brewers of tomorrow may operate more like Amazon than a traditional brewery.

——————————————————————————–

4. In a Cost-of-Living Crisis, Premium Beer Is… Thriving?

Herein lies a paradox: while a cost-of-living crisis has led 77% of operators to report a decrease in people eating and drinking out, the premium beer category is showing remarkable resilience. At Heineken, for example, premium beer volume has grown in the majority of its markets.

This counter-intuitive success is not accidental. Major brewers are achieving it by building a “premium experience” that extends far beyond the product itself. They are connecting with consumers through innovation and cultural relevance. Key examples include:

• Innovation for New Demographics: The launch of Tiger Soju Infused Lager was a strategic move to bring the Tiger brand to younger generations. The campaign, a collaboration with South Korean artist G-Dragon, successfully blended Asian cultures to create a novel product experience.

• Brand Extensions: Power brand innovations like Heineken® Silver and Tiger Crystal are expanding the core portfolio to meet new consumer needs, together driving impressive growth of 42%.

This trend suggests that consumers are “trading up” on fewer occasions. Even when money is tight, a significant segment is willing to pay more for brands that offer novelty, cultural cachet, and a sense of occasion that justifies the premium price in a way a standard lager cannot.

——————————————————————————–

5. The Future of Beer Is About Selling a Better World

Modern brand-building is increasingly moving beyond the product to embrace a wider, social purpose. As the late Freddy Heineken famously stated, this philosophy is embedded in the company’s DNA:

“We don’t sell beer, we sell gezelligheid.”

Today, that sentiment is being translated into tangible action through large-scale social and environmental responsibility initiatives. Heineken’s “Brew a Better World” strategy provides a clear blueprint for this shift, with concrete examples:

• Making Nightlife Safer: The Desperados brand launched its “Doorperson Diploma,” an initiative to educate security staff on how to make dance floors more inclusive and safe for everyone.

• Promoting Responsible Consumption: The flagship Heineken® brand is working to make moderation cool. Through a partnership with F1 and champion Max Verstappen, it launched Player 0.0, a simulation-racing series that sends a powerful message of responsible consumption directly to the global gaming community.

• Environmental Action: This commitment is backed by measurable results. The company has reduced its scope 1 and 2 emissions by 34% compared to its 2018 baseline, demonstrating tangible progress toward its net-zero goals.

This represents a fundamental strategic shift. Brands are creating value and fostering deep loyalty by aligning with their customers’ values on critical issues like safety, health, and sustainability.

——————————————————————————–

Conclusion: The Future on Tap

The seemingly simple local pub and the global beer industry it supports are at a crossroads. Their future is being shaped by a complex interplay of forces, from local debt and regulation to global technology and evolving social values. These colliding forces—debt, data, regulation, and responsibility—are now embedded in every transaction at the bar.

The next time you’re at the bar, what are you really supporting—a drink, a tech platform, a social mission, or the simple survival of a cherished institution?