The British pub is more than just a business; it’s a cornerstone of community, a place of familiar comfort and local character. From the polished brass pumps to the well-worn bar stools, these institutions form a vital part of the national identity. But behind the swinging signs and frosted glass, a high-stakes battle of business philosophy is being waged, with the future of thousands of local pubs hanging in the balance.

At the heart of this conflict are the two largest pub companies in the United Kingdom: Marston’s and Stonegate. On the surface, they might seem similar—sprawling estates of pubs serving communities up and down the country. Yet a look at their balance sheets reveals two companies on starkly different paths, driven by polar-opposite financial models.

One is executing a strategic escape from its past to invest in its future, while the other is trapped by a financial structure of its own making. These divergent strategies are creating dramatically different realities for their pubs, their publicans, and ultimately, the communities they serve.

The “Retail” War: Why Marston’s is Winning Hearts While Stonegate Fights Debt

Date: December 2024 | Source: Pubs Code Adjudicator (PCA) 2024 Survey

In the high-stakes world of UK hospitality, 2024 has drawn a sharp battle line between the country’s two giants. The latest data reveals a stark “Good Cop, Bad Cop” dynamic that every prospective tenant needs to understand before signing a lease.

🚀 Executive Summary

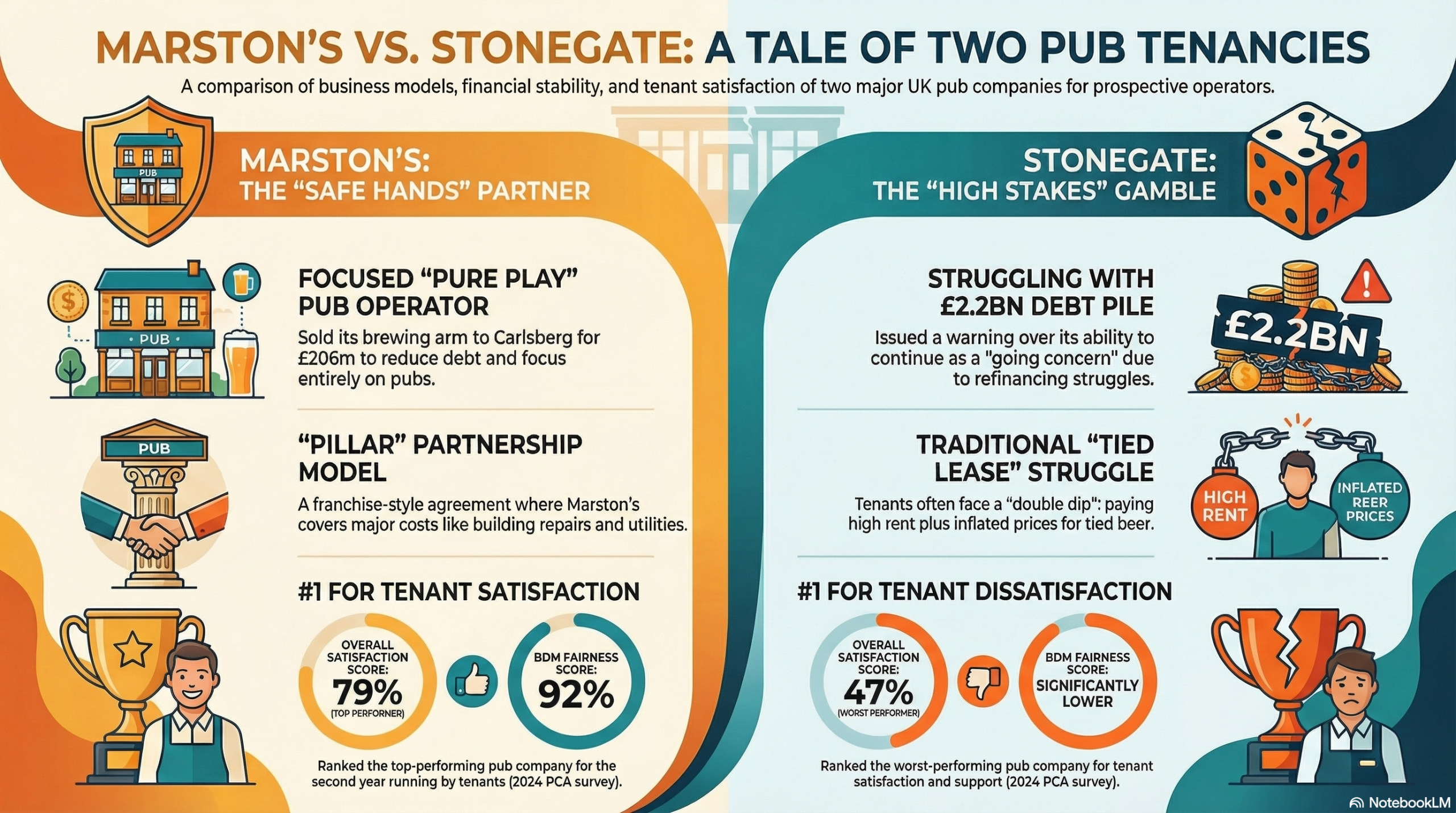

- The Winner: Marston’s ranks #1 with a 79% satisfaction score (“The Gold Standard”).

- The Loser: Stonegate ranks last with 47% (“The Warning Sign”).

- The Driver: Marston’s sold its brewing arm to pay down debt; Stonegate remains burdened by private equity leverage.

1. The Satisfaction Chasm (2024 PCA Data)

The numbers from the 2024 Pubs Code Adjudicator survey are not just statistics; they are a verdict on corporate culture and financial health.

Marston’s

79%Tenant Satisfaction

(Ranked #1)

Stonegate

47%Tenant Satisfaction

(Ranked Last)

Notably, 92% of Marston’s tenants believe their Business Development Manager (BDM) acts fairly, highlighting a culture of partnership rather than extraction.

2. The Financial “Why”: Pure Play vs. Debt Anchor

Why is Marston’s behaving like a partner and Stonegate like a debt collector? The answer lies in the balance sheets.

Marston’s: The “Pure Play” Pivot

In 2024, Marston’s sold its 40% stake in Carlsberg Marston’s Brewing Company for approximately £206m. This was a strategic masterstroke.

- Debt Reduction: They slashed net debt to ~£885m.

- Focus: They are no longer a brewer; they are purely a pub operator.

- Impact: Financial breathing room allows for investment in repairs and “Pillar” partnership support.

Stonegate: The Debt Anchor

Stonegate remains the largest pub company in the UK, but industry insiders cite a private equity debt pile exceeding £2bn.

3. The Model War: “Pillar” vs. “The Tie”

The Marston’s “Pillar” (Retail Agreement)

Marston’s is aggressively pushing its franchise-style model. They pay for the building, insurance, repairs, and stock. The tenant pays for staff.

- The Upside: The “Safety Net.” Marston’s owns the stock, so they are incentivized to keep the roof fixed and the pub trading.

- The Trap (Wage Squeeze): You earn a ~20% commission on sales. With the National Living Wage rising to £12.21 (April 2025), you must ensure your commission covers your staff costs during quiet periods.

The Stonegate Reality (Tied Leases)

Stonegate relies heavily on traditional tied leases where you pay rent plus inflated beer prices.

- The Upside: Potential for higher profit if turnover is massive.

- The Trap (Dilapidations): Stonegate leases often shift structural liability to the tenant. Exiting tenants frequently report massive “Dilapidations Schedules”—bills for repairs aimed at stripping deposits.

4. The Verdict: Which Avatar Are You?

| Feature | Marston’s Avatar (“Safe Hands”) | Stonegate Avatar (“Gambler”) |

|---|---|---|

| Ideal For | Skilled Managers with low capital (<£50k) | Hardened Entrepreneurs / Negotiators |

| Risk Profile | Low Risk (Landlord pays repairs) | High Risk (Tenant liable for building) |

| Primary Trap | Wage Squeeze vs. Commission | Dilapidations & The Tie |

| Mindset | “I want a partner to pay the bills.” | “I want to fight for every margin.” |

Disclaimer: This analysis is based on the 2024 PCA Survey data and corporate accounts. Always seek independent legal advice before signing a pub lease.

——————————————————————————–

1. The UK’s Biggest Pub Company is Also Its Worst Landlord

Stonegate Pub Company holds the title of the UK’s largest pub operator, with a massive estate of around 4,800 pubs. This scale, however, is dramatically overshadowed by its reputation as a landlord. According to the official 2024 survey from the Pubs Code Adjudicator (PCA), Stonegate ranks as the worst-performing landlord for tenant satisfaction, with a score of just 47%.

This is not an unfortunate coincidence; it is the inevitable consequence of its financial strategy, a model best described as “The Debt Anchor.” Burdened by a debt pile exceeding £2 billion and owned by private equity firm TDR Capital, Stonegate’s entire operational reality is dictated by the need to service its loans. This immense pressure forces the company to view its tenants not as partners, but as sources of cash flow, making its rock-bottom satisfaction score a direct outcome of its balance sheet.

2. A 190-Year-Old Brewer Quit Brewing to Save Its Pubs

In a move that seemed to defy 190 years of history, Marston’s correctly identified that its future success depended on killing its past. In July 2024, the company, founded in 1834, sold its remaining stake in its historic brewing arm to its partner, Carlsberg, for £206 million. This was the final step in a deliberate escape from a legacy model.

This historic “Pure Play Pivot” transformed Marston’s into an operator focused exclusively on running its estate of over 1,350 pubs. The decision was not about heritage but about liberation. The cash injection was immediately used to slash debt, giving the company the financial breathing room needed to reinvest in its properties and, crucially, in its partnerships with its publicans.

3. Why One Tenant Sleeps Soundly While the Other Calls a Lawyer

The massive 32-point gap in tenant satisfaction—Marston’s at a gold-standard 79% versus Stonegate’s 47%—can be traced directly to one fundamental question: who is responsible for the building? The answer reveals the difference between a partnership and a battleground.

Marston’s model is “The Shield.” Its franchise-style “Pillar Partnership” absorbs risk for the publican. Marston’s covers the big-ticket items: rent, building insurance, all repairs and maintenance, and often utilities. This allows the publican to focus on running the business without the fear of a catastrophic bill for a new roof.

Stonegate’s model is “The Bill.” Its traditional “Tied Lease” is designed to transfer risk. Here, the tenant is often liable for all structural repairs. This strategy of “Dilapidations Weaponization” becomes clear when a publican tries to leave and is hit with a massive repair bill that can trap them financially.

Marston’s debt-light balance sheet underpins its ability to offer “The Shield.” It isn’t servicing massive loans; it’s generating cash that can be reinvested into its properties. As CEO Justin Platt states, the company’s focus is clear:

“We’ve delivered another strong year ahead of plan, executing on our strategy to be a high-margin, highly cash-generative local pub company.”

4. The Smartest Pubs are Going Green—With Zero Upfront Cost

The “financial breathing room” gained from selling the brewing arm is not just a line on a balance sheet; it is enabling tangible, forward-looking investments. A prime example is Marston’s major initiative to deploy solar panels across the rooftops of 120 of its pubs, a project that demonstrates both financial savvy and environmental commitment.

The most innovative part of this project is its financing. The entire rollout is funded through a Power Purchase Agreement (PPA), meaning Marston’s did not have to spend a single pound of its own capital. Through the PPA, Marston’s gets guaranteed, predictable energy prices for the next 25 years, shielding it from market volatility. The project will cut carbon emissions by 600 tonnes in the first year alone—equivalent to taking 430 cars off the road.

“This is the first multi-site Power Purchase Agreement rollout of its kind for a large pub chain in the UK. Our standardised framework simplifies deployment across hundreds of sites, offering Marston’s a single, predictable energy rate for 25 years—insulating them from market swings while removing upfront costs.”

– Daniel Levene, Co-founder of Two Blues Solar

5. One Giant is Teetering on a £2.2 Billion Debt Mountain

The financial reality facing Stonegate is stark. The company has been openly struggling to refinance a staggering £2.2 billion debt pile, a situation so serious that its own annual report issued a formal warning. Auditors noted that a “material uncertainty exists that may cast significant doubt on the company and group’s ability to continue as a going concern.”

This enormous debt, the engine driving its extractive tenant relationships, was largely acquired during its £1.3 billion purchase of rival Ei Group in 2019—a deal that closed just before the COVID-19 pandemic decimated the hospitality industry. Owned by private equity firm TDR Capital and domiciled in the Cayman Islands, the company now faces a crippling combination of high interest rates and a business model that puts it at odds with its own publicans.

——————————————————————————–

Conclusion: A Tale of Two Futures

The divergence between these two giants tells a clear story. Marston’s has executed a strategic escape, transforming itself into a debt-light, focused pub operator committed to investing in its estate and its partners. In contrast, Stonegate remains shackled by a mountain of private equity debt, a reality that forces an adversarial relationship with its publicans and casts a long shadow over its future.

So, the next time you order a pint, it’s worth considering what it’s really paying for: a sustainable future for your local pub, or the interest on a balance sheet?