The British pub is an institution, a cornerstone of community life steeped in tradition. It’s a familiar image of warm beer, a crackling fire, and friendly conversation. But behind this comfortable facade, a high-stakes corporate chess match is unfolding, driven by radical strategies that will define the future of these beloved local hubs for decades to come.

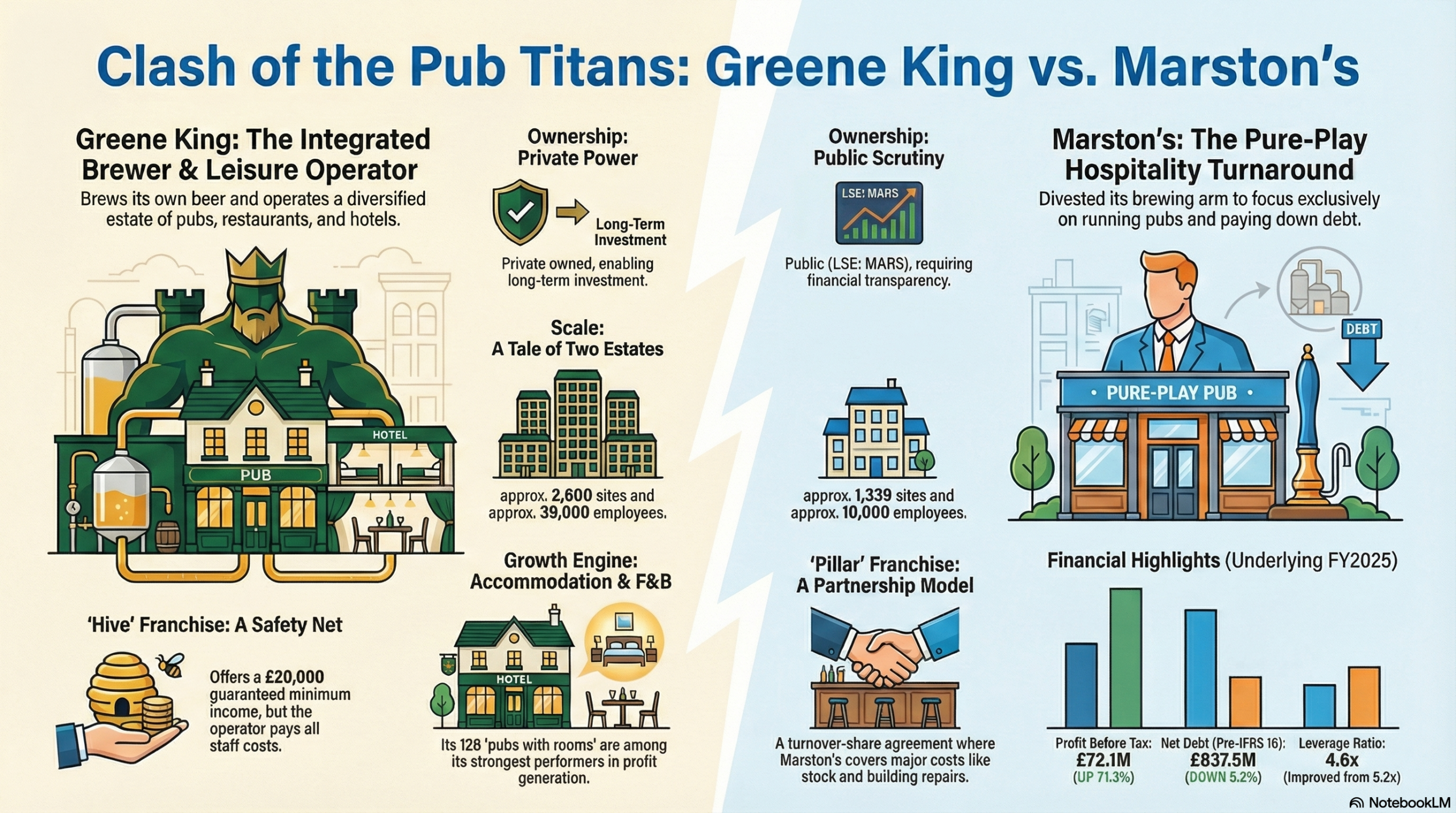

At the center of this battle are two industry titans, Greene King and Marston’s. While both are giants of the industry, they are pursuing fundamentally different paths to secure their futures. This divergence is not accidental; it’s a direct ripple effect of their ownership. One, a private company, is playing a long, patient game of empire-building, while the other, a public entity, is executing a disciplined and urgent financial turnaround.

This article cuts through the noise to reveal the five most surprising and impactful strategic truths emerging from the battle between Greene King and Marston’s. From counter-intuitive regulations to hidden franchise risks, these are the forces shaping the pub on your corner.

The Battle of the Titans:

Greene King vs. Marston’s

Two industry giants. Two franchise models. One critical choice. We break down the data to help you decide between “The Brand” and “The Pub.”

The Satisfaction Index

Based on Pubs Code Adjudicator (PCA) 2024/25 Data

MARSTON’S

THE PURE PLAYSold their brewing arm to Carlsberg. Now 100% focused on retail and guest experience. They are operators, not brewers.

GREENE KING

THE BREWERBacked by CK Asset Holdings. A massive vertically integrated brewer and operator. Deep pockets with £27m earmarked for 2025.

Hive vs. Pillar

The Franchise War Explained

The Hidden Trap: Staff Costs

In both models, you pay the staff. This is the critical risk factor. If revenue drops, your fixed labor costs remain. Be especially wary of the Greene King “Nest” model which has no guaranteed income floor.

Greene King “HIVE”

The Safety Net Model

-

£20,000 Guarantee

Minimum earnings floor (Hive only).

-

Entry Cost: £5,000

Reasonable entry for a full franchise.

-

The “System”

Highly structured. You follow the manual exactly.

Marston’s “PILLAR”

The Retailer’s Choice

-

Full Repair Cover

Marston’s covers internal & external repairs.

-

Food Focus

Superior menu development and EPOS tech.

-

Growth Support

92% Fairness Score for sales support.

The Repair Reality Check

This is the single biggest differentiator. Do not overlook the state of the building.

Marston’s: Asset Protection

Scores highest for “Quality of Repairs”. They view the building as their primary asset because they don’t have brewing profits to fall back on.

Greene King: The Dilapidations Risk

While Hive covers repairs, standard leases often do not. Tenants frequently complain about slow responses to structural issues compared to the franchise division.

Repair Responsibility

Which Operator Are You?

The System Operator

Greene King Profile

“I want the ‘McDonald’s of Pubs’—give me the manual, the brand, and the guaranteed cash.”

- Wants a turnkey business

- Needs the £20k income guarantee

- Happy to sell big brands (IPA)

The Foodie Entrepreneur

Marston’s Profile

I want a partner who cares about the customer as much as I do, not just selling me their own beer.”

- Focused on guest experience

- Wants superior food support

- Values 100% repair coverage

Frequently Asked Questions

Which pub franchise is cheaper to enter?

Greene King’s “Nest” model has an entry cost of £3,000, while the “Hive” model is £5,000. Marston’s Pillar Partnership costs vary by site but generally require a similar low ingoing cost compared to traditional leases.

Does Marston’s still brew beer?

No. Marston’s sold their brewing arm to Carlsberg in 2024. They are now a “Pure Play” operator, meaning they focus entirely on running pubs rather than brewing beer.

What is the biggest risk with franchise pubs?

Staff costs. In both the Hive and Pillar models, the franchisee (you) is responsible for paying staff. If sales drop, your labor costs remain high, which can eat into your commission.

——————————————————————————–

1. A 190-Year-Old Brewer Quit Brewing (And It’s Working)

In a move that sent shockwaves through the industry, Marston’s, a company with a brewing legacy stretching back nearly 190 years, sold its brewing operations to Carlsberg. The goal was to transform into a “pure-play hospitality business” with one single-minded objective: aggressive debt reduction. By divesting its breweries, Marston’s fundamentally strengthened its financial position and de-risked its business model.

The results of this high-stakes gamble are startling. According to its full-year preliminary results for fiscal year 2025, Marston’s total revenue was essentially flat, decreasing by just 0.1%. Yet, its underlying Profit Before Tax surged by an incredible 71.3%. This disparity is the key to understanding their strategy. The dramatic profit growth didn’t come from selling more beer and food; it came from a “deleveraging dividend,” where every pound saved on interest costs from reduced debt converted operational profit directly into a healthier bottom line.

This was a radical break from tradition, but one made necessary—and possible—by the relentless demand of the public market for a clean balance sheet and a simple, focused equity story.

——————————————————————————–

2. A Law to Help Pub Tenants May Be Stifling Investment

The Pubs Code, and its Market Rent Only (MRO) option, was introduced as a well-intentioned regulation to protect the rights of pub tenants and ensure they get a fair deal. However, according to Greene King, the legislation is having a chilling, counter-intuitive effect on the very industry it was designed to support.

The core of Greene King’s argument is that the mere threat of a tenant triggering the MRO option discourages the company from making long-term investments in its properties. This has several negative consequences. Pub companies are increasingly offering shorter five-year leases to avoid MRO trigger events like rent reviews, which Greene King calls a “barrier to entrepreneurship.” It also makes them hesitant to commit significant capital to pub refurbishments and prevents them from using their scale to help tenants—for example, by bulk-buying energy at lower prices—because passing on a future price increase could trigger an MRO event.

The data from Greene King’s submission to Parliament is telling: of 1,231 available MRO triggers, the company has granted only 14 MRO agreements—just 1% of the triggers available—and only 8 live MRO agreements remain in place, suggesting very low tenant uptake. Yet, the cost of compliance is staggering, estimated at over £500,000 per year for Greene King, which climbs to almost £1,000 per pub when the regulatory levy is included. This situation highlights a clash between a long-term private owner’s desire to make capital investments and a regulation that introduces short-term uncertainty.

——————————————————————————–

3. The ‘Safest’ Pub Franchise Has a Hidden Catch

For aspiring publicans, franchise-style “Retail Agreements” have become a popular, low-cost entry point into the business. On the surface, Greene King’s “Hive” model appears to be the safest bet on the market, offering a £20,000 Guaranteed Minimum Earnings on a very low £5,000 entry cost.

However, there’s a hidden catch in the fine print. In both Greene King’s food-focused “Hive” model and its wet-led “Nest” model, the franchisee is responsible for paying all staff costs. This creates a significant risk, particularly for the “Nest” pubs, which have no guaranteed income. If a “Nest” pub has a slow month, the operator still has to pay the bar staff out of their own pocket, potentially earning zero or even losing money.

This stands in contrast to Marston’s “Pillar Partnership” model, where the company explicitly covers the cost of stock and all building repairs. The reason for this difference is a direct result of Marston’s strategic pivot: as a pure-play hospitality operator, they must protect their core assets. They “protect the asset better because they don’t have a brewing arm to subsidize a crumbling estate.” This strategic difference is best summarized by a sharp industry observation:

“Marston’s is the retailer’s choice; Greene King is the salesman’s choice.”

——————————————————————————–

4. The Future of Pubs Isn’t Beer—It’s Beds, BBQ, and Big Data

The traditional assumption that a pub’s success is measured in pints sold is rapidly becoming obsolete. The real growth drivers for modern pub companies are found in diversified revenue streams and data-driven efficiency, moving far beyond the bar.

Greene King provides a powerful example of diversification, a luxury afforded by patient private capital. The company has stated that its “pubs with rooms” are among its “strongest performers in terms of profit generation and growth.” It has also found massive success with standalone food and beverage strategies, most notably through its 2022 acquisition of the Hickory’s BBQ smokehouse brand. The impact has been transformative; in one case, converting a pub doing £20,000 per week into a Hickory’s resulted in a “£100,000 per week success.”

Marston’s, in contrast, is executing a classic public company move to boost margins without massive capital outlay. The rollout of its new Order & Pay platform has already supported a 10% increase in spend per guest by encouraging upselling. Furthermore, its data-led “Right People, Right Time” labor model has been so successful at optimizing schedules that it has fully offset the financial impact of national minimum wage increases. For these industry titans, the future isn’t just about selling beer—it’s about selling experiences, overnight stays, and leveraging every piece of data to run a smarter, more profitable business.

——————————————————————————–

5. One Titan is Building an Empire, The Other is Fixing Its Books

The most fundamental difference between Greene King and Marston’s—the one that dictates every other strategic decision—is their ownership. Greene King is privately owned by CK Asset Holdings, a Hong Kong-based real estate firm. Marston’s is a Publicly Listed Company (PLC) on the London Stock Exchange.

Being private allows Greene King to play the long game. It can pursue “structurally complex growth initiatives”—like maintaining vertical integration as a brewer and patiently expanding its portfolio of hotels—that have slow but potentially massive returns, without the pressure of quarterly earnings reports for public shareholders.

Marston’s, as a public company, has a different mandate: deliver transparent financial milestones to its shareholders. Its strategy represents a defined “turnaround play” suitable for capital seeking measurable upside tied to financial milestones. Its primary goal is deleveraging, and it has already reduced its leverage ratio from 5.2x to 4.6x, with a firm target of below 4.0x. Marston’s has been explicit that it will not recommence shareholder returns until this target is met. This contrast in ownership is the “why” behind every other strategy, explaining Greene King’s patient pursuit of a diversified leisure empire versus Marston’s disciplined and urgent mission to repair its balance sheet.

Conclusion

The familiar, comforting image of the British pub has become the stage for a fascinating strategic divergence. On one side, Greene King leverages its private ownership and integrated scale to build an all-encompassing leisure and hospitality empire. On the other, a newly focused Marston’s executes a public, disciplined turnaround, betting that a lean, financially robust model is the key to future success.

These two distinct corporate philosophies are not just business school case studies; they are actively shaping the future of community hubs across the country. As these two giants forge their distinct paths, a crucial question emerges: Which model will ultimately define the local pub of the next decade—the all-in-one leisure destination, or the hyper-efficient, community-focused hub?