For many, the dream of running a local pub is a powerful one—pulling pints, hosting the weekly quiz, and being the heart of a community. But behind the romantic vision lies a complex business reality. Choosing the right pub company to partner with is the single most important decision a potential landlord will make, and it’s a choice that has become dramatically more complicated in the last two years.

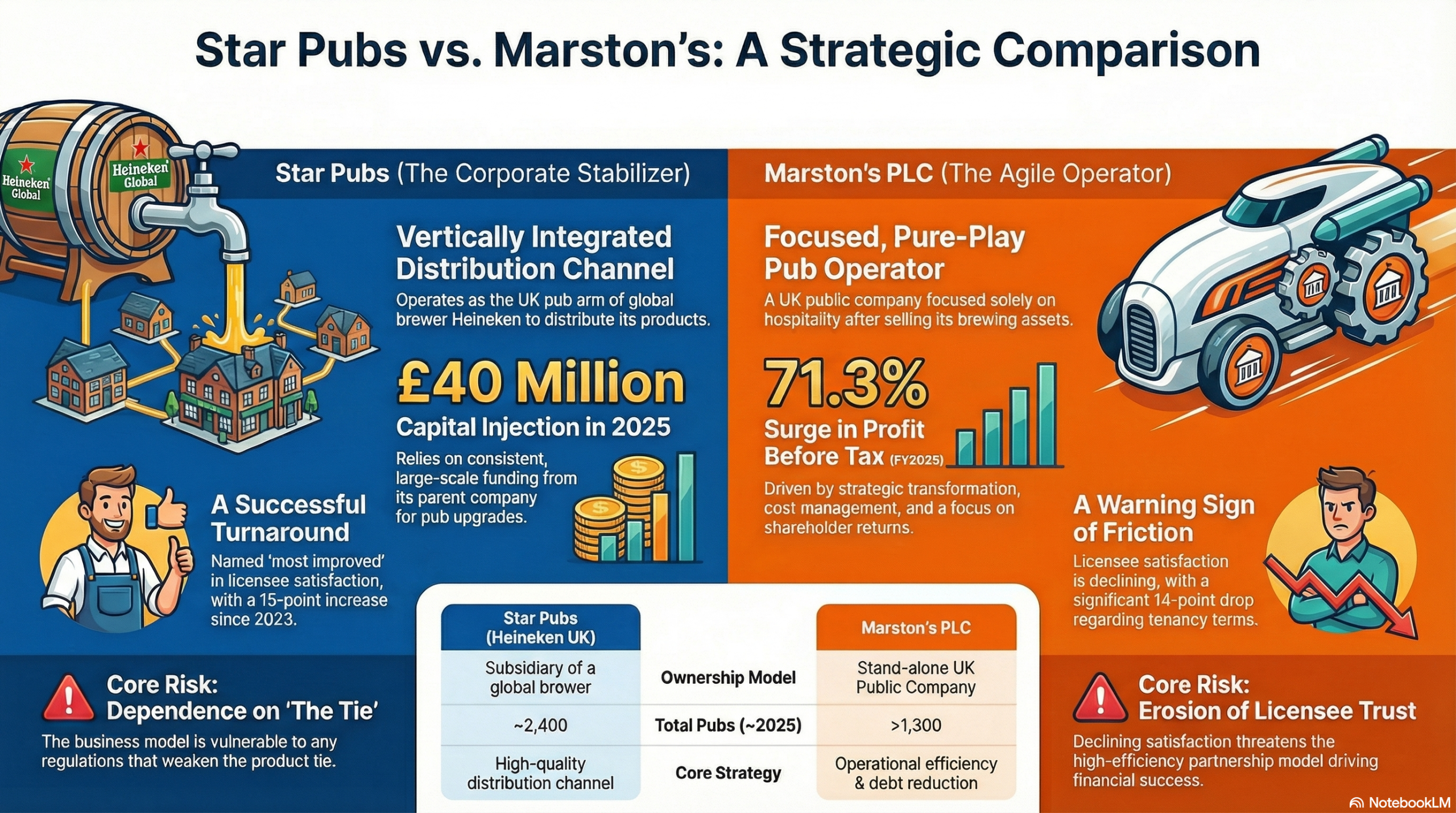

A quiet but significant “momentum war” is currently raging between two of the UK’s biggest pub companies, Star Pubs (owned by Heineken) and Marston’s. While both offer seemingly attractive, low-cost entry models, the balance of power between them is shifting dramatically. One is spending millions to win over tenants, while the other is focused on paying down debt.

This post reveals the most surprising and impactful takeaways from this industry shake-up. Based on the latest survey and financial data, we’ll uncover who is rising, who is sliding, and what it really means for anyone looking to take on their first or next pub.

“The Operator” vs. “The Aggressor”

The Safe Pair of Hands

Focus: Deleveraging & Optimizing. A “Retailer” first, strictly focused on guest experience standards.

Cons: Strict compliance, slower to pivot.

The Hungry Wolf

Focus: Empire Building. Owned by Fortress (Softbank). Posted 44% profit uplift via aggressive acquisition.

Cons: High pressure on ROI, ruthless number tracking.

Marston’s Pillar Partnership

The “Foodie” Choice. Best for operators who want a destination venue.

~30-35% Food Sales

Punch Management Partnership

The “Community” Choice. Best for operators who want to lower overheads.

+ Performance Bonuses

Profit Simulator: The “Wage Bill” Effect

See how staff costs change the winner. Marston’s (Food) requires more staff than Punch (Drink).

The Number #1 Complaint in 2024: Repairs.

Marston’s: Generally takes responsibility for the building structure. Their PCA Satisfaction score (79%) reflects this.

Punch: Often pushes more maintenance liability onto the tenant in their older leases. Make sure you clarify who pays for the boiler before you sign.

Verdict: Which Avatar Are You?

Select your personality type to see the match.

The General Manager

- Career hospitality professional.

- Loves food service & complex operations.

- Wants corporate safety (HR/Legal support).

- Willing to follow strict brand standards.

The Local Hero

- Charismatic, knows everyone in town.

- Hates the hassle of commercial kitchens.

- Wants a “wet-led” boozer & quiz nights.

- Wants money spent NOW on the building.

What is the ‘Exit Strategy’ if I fail?

Punch: Management Partnerships often have a 6-month break clause, making it a potentially “safer” bet if you aren’t sure you’ll survive the first year.

Who pays for the beer stock?

Why is Marston’s satisfaction so much higher?

“Marston’s is a slow, steady cruise ship. Punch is a speedboat driven by Private Equity. Punch gives you a shiny bar today, but expects results tomorrow.”

“Food vs. Drink: Why your Staff Wage Bill makes Punch the ‘Hidden Winner’ over Marston’s for new operators.”

1. The Great Satisfaction Flip: How a Giant is “Sliding” While a Rival is “Rising”

The most telling sign of the power shift can be found in a single metric: tenant satisfaction. Just two years ago, the landscape was completely different, but a massive reversal of fortunes is now underway.

The “Most Improved” vs. The “Sliding Giant”

According to the latest 2025 Pubs Code Adjudicator (PCA) survey data, Star Pubs has executed an unprecedented turnaround. Tenant satisfaction has surged from 55% in 2023 to around 70% today as they actively buy their reputation back, making them the “most improved” landlord in the sector. In contrast, Marston’s has seen its satisfaction rating drop by approximately 7 points to 72%. While still highly rated, it is undeniably losing its “Gold Standard” crown to a resurgent competitor.

The reason for this flip is simple: one partner is acting as a “Sugar Daddy” while the other is on a strict “Debt Diet.” Star Pubs‘ parent company, Heineken, confirmed a £40 million investment into its pub estate in May 2025, funding major refurbishments. Marston’s, on the other hand, is focused on servicing its ~£885 million debt and conserving cash.

“Marston’s is cutting debt; Heineken is writing checks. Who would you rather partner with?”

2. The Hidden Safety Net: Both Sides Will Pay Your Biggest Bill

Despite the growing divergence in strategy and satisfaction, the two companies share a massive, often overlooked, benefit in their franchise-style models. This isn’t just a perk; it’s a shared competitive advantage that makes them fundamentally safer options than many rivals.

Both Star’s “Just Add Talent” model (with an entry cost of around £4,000) and Marston’s “Pillar Partnership” model (around £5,000 entry) cover the pub’s energy bills. In a market where tenants on traditional leases with other major pubcos can be “crushed” by unpredictable utility costs, having the parent company absorb this risk is a critical safety net. This single policy makes both companies structurally less risky for new operators.

3. The Real Difference: It’s Not the Rent, It’s the Reward

While both are “turnover share” models where you pay no traditional rent, the real difference isn’t in the basic costs—it’s in the earning potential.

The Star Pubs “Just Add Talent” model has a distinct edge for ambitious operators. You earn 20-30% of Net Turnover and, crucially, are offered an Uncapped Quarterly Profit Share. This means if you significantly outperform your targets, you receive a share of the actual profits, not just a percentage of sales. This structure powerfully aligns incentives for high performers.

The Marston’s “Pillar” model offers a share of around 20% of Wet Sales (higher on food) but is often criticized for being “tight” on controllable costs like labor. As a “Pure Play” pub operator, Marston’s only path to profit is through the pub’s day-to-day operations, making them highly sensitive to costs like labor. Heineken, with its vast brewing profits, can afford to subsidize its deals to achieve its main goal: selling more of its own beer.

4. The Brand War: Global Powerhouse vs. The Independent Retailer

The company you partner with directly dictates the products you sell, shaping your pub’s identity and profitability. Here, the two companies represent fundamentally different philosophies.

The Heineken Machine

Partnering with Star Pubs means plugging into a global marketing powerhouse. Your pumps will be filled with premium, globally recognized brands like Heineken, Birra Moretti, Beavertown, and Cruzcampo. The advantage is that these products command a high price per pint and come with world-class marketing. The downside is the lack of flexibility; you are strictly tied to the Heineken portfolio.

The Community Retailer

Since selling its brewing division, Marston’s operates more like a retailer than a traditional brewer. While you’ll feature core brands like Pedigree, their core interest is in what sells, not just in pushing their own manufactured products. This can offer more flexibility for guest ales that cater to your community. However, their brand portfolio is often seen as more “Traditional” than “Trendy” and lacks the premium, image-driven power of Star’s brands.

Conclusion: Which Pub Operator Are You?

The battle between Star Pubs and Marston’s presents a clear choice for any aspiring pub landlord. There is no single “winner,” only the right fit for a specific type of operator.

The central conflict is between a high-investment, premium-brand, high-reward model (Star) and a stable, community-focused partnership that is more financially conservative (Marston’s). Are you the “Premium Operator” who wants to run a busy, noisy, premium city-center or high-street pub, leveraging a £40 million investment fund and selling world-famous lagers? Or are you the “Community Host” who wants to run a proper “local” with a food focus, preferring the stable partnership of a company that, crucially, understands food better than Heineken?

Faced with the choice between explosive investment and proven stability, which path would you take?