For many, the dream of running a quintessential British pub is a powerful one. It’s a vision of becoming the heart of a local community, pouring pints for regulars, and building a business that is more than just a balance sheet—it’s a cornerstone of British life. It’s a dream of warmth, camaraderie, and independence.

But the reality of that dream often hinges on a single, crucial relationship: the one a publican has with their corporate landlord, the pub company or “pubco.” The success or failure of a tenanted pub, its ability to thrive or its slow slide into closure, can be directly traced back to the business model of the company that owns the bricks and mortar.

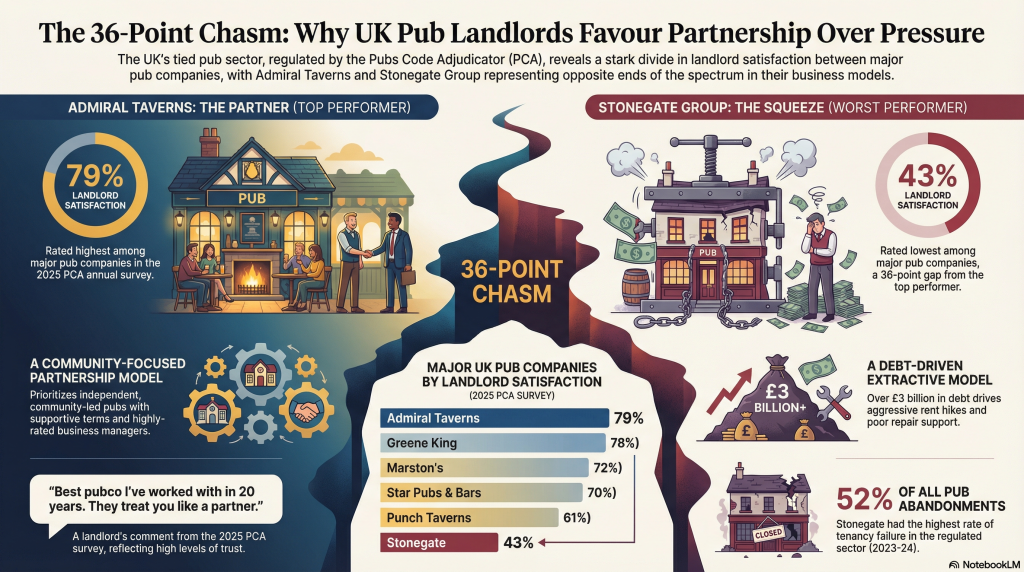

A deep dive into official industry data reveals a shocking divide between the UK’s pub giants, exposing two fundamentally different approaches to partnership. On one side, a model built on community and support. On the other, a high-pressure system that squeezes tenants to service corporate debt. Here are the five most surprising takeaways from the data that every aspiring publican should know.

1. Bigger Isn’t Better: The Landlord Satisfaction Chasm

In most industries, market leadership and scale are presumed to correlate with a superior customer experience. In the UK’s tenanted pub sector, however, official data reveals the precise opposite is true. The country’s biggest pub company, Stonegate Group, has the least satisfied tenants in the industry, and by a staggering margin.

According to the Pubs Code Adjudicator’s (PCA) 2025 Annual Tied Tenants Survey, as reported by industry publication Pub & Bar, Stonegate scored a dismal 43% in landlord satisfaction. This was the lowest score of any major pub company. In stark contrast, Admiral Taverns, a group championing community pubs, consistently ranks as a top performer, achieving a 79% satisfaction rating. This creates a massive 36-point gap between the best and the worst, challenging the notion that scale equates to quality.

This chasm in landlord experience isn’t just a number; it represents two completely different realities for the people running the pubs. As one publican who made the switch noted in the PCA survey:

“I left Stonegate for Admiral — the difference is night and day. I feel like I run my pub now, not them.”

The Tenant Satisfaction Gap

Comparative Analysis: Stonegate Group vs. Admiral Taverns

Data Source Authority

Data derived from the Pubs Code Adjudicator (PCA) Annual Tenant Insight Survey. This is the government regulator’s objective measure of tenant sentiment in the UK.

Stonegate Group

Worst PerformerHistoric Low

Tenants who feel treated fairly

Admiral Taverns

#1 Top PerformerConsistently High

Tenants who feel treated fairly

The Stonegate “Squeeze”

£2.2 Billion

Estimated Debt Burden

The “Fairness” Gap

35%

Differential in Fairness Scores

The Admiral Strategy

~1,600 Pubs

Focused Estate

——————————————————————————–

2. Your Landlord’s Debt Is Your Problem

The vast satisfaction gap isn’t random; it’s a direct consequence of corporate financial health. A pubco’s debt burden has a direct and often painful impact on the daily life of its publicans. Stonegate operates under immense financial pressure, grappling with a substantial £3 billion debt burden and reporting pre-tax losses of £214 million for the financial year ending September 2024.

This corporate pressure isn’t accidental; it’s a direct consequence of a business model built on high debt, where the need to service a £3 billion liability rolls directly downhill to the tenant. To generate cash flow for its lenders, the company operates an “extractive” model, leading to widespread tenant complaints. According to PCA survey data, Stonegate landlords reported significant issues in core areas of their business:

• 45% complained about unfair rent reviews.

• 51% flagged issues with supply pricing and the restrictive beer tie (the obligation to buy beer and other products from the pubco).

• Repairs were frequently described as “poor” or “delayed.”

This approach engineers an adversarial relationship. The landlord, instead of feeling like a partner, becomes a revenue stream to be maximized, bearing the brunt of financial decisions made in a distant boardroom.

——————————————————————————–

3. The “Community Partnership” Model Is Winning

While Stonegate’s debt necessitates an extractive model, Admiral Taverns proves a different path is not only possible, but more successful. The company has built its reputation as the “community pub champion,” founded on partnership, licensee support, and the long-term viability of the local pub as an institution.

The data shows this approach is paying dividends in landlord loyalty and operational success. Admiral’s key performance indicators are a mirror image of Stonegate’s:

• Their Business Development Managers (BDMs)—the main point of contact for landlords—ranked highest in the sector with a satisfaction score of 7.8/10.

• An overwhelming 82% of their tenants reported being treated fairly in rent negotiations.

• Their “people-first approach” was recognised when they won the ‘Best Recruitment Strategy’ award at the 2025 National Innovation in Training Awards (NITAs).

This philosophy of mutual success is core to their identity. As Admiral Taverns’ CEO, Chris Jowsey, stated, the goal is to build a sustainable ecosystem where everyone wins:

“Pubs are the cornerstone of communities across the UK both socially and economically and they deserve our support. … When combined, and at their best, these partnerships create thriving, successful pubs that benefit their local communities for generations to come.

——————————————————————————–

4. There’s a Landlord Exodus at the Bottom

Low satisfaction isn’t just about unhappiness; it translates into tangible business failure and high turnover. When a pubco’s model becomes unsustainable for its tenants, they don’t just complain—they leave.

The official data on tied pub abandonments reveals a landlord exodus at the sector’s bottom performer. According to the Pub-Owning Businesses’ Compliance Reports for 2023-24, Stonegate was responsible for 41 abandonments. This figure represents 52% of the total tied pub abandonments across the entire regulated sector.

This isn’t just tenant turnover; it’s a catastrophic business failure rate that serves as the ultimate indictment of an extractive model. When more than half of all pub failures in the regulated sector come from a single company, it signals that the partnership has become fundamentally unsustainable for those on the front line.

——————————————————————————–

5. The Rules Only Work When a Company Plays Fair

To prevent exploitation, the industry is regulated by the Pubs Code, which is enforced by the Pubs Code Adjudicator (PCA). This framework acts as a referee, intended to ensure fairness, particularly around rent agreements and the right for tenants to go “free of tie.” However, the rules are only effective when a pubco’s internal culture is geared towards compliance.

Stonegate has faced regulatory scrutiny over its practices. The PCA found that some of its Market Rent Only (MRO) agreements contained non-compliant rent review terms, leading to the company being required to offer changes to around 70 lessees.

This contrasts sharply with Admiral Taverns, whose culture of compliance was praised by the PCA in 2019. The adjudicator at the time made a telling observation:

“Admiral Taverns stand out – they have not had a single referral for PCA arbitration in the three and a half years that the Pubs Code has been in force. … [they have] embraced the Code with a culture of making compliance work for their business.”

This demonstrates that a company’s attitude towards regulation is a crucial factor. For some, the Code is a set of principles to be followed to build fair partnerships. For others, it appears to be a set of hurdles to be navigated or overcome. This fundamental difference in corporate culture is a key driver of the 36-point satisfaction gap.

——————————————————————————–

Conclusion: A Tale of Two Pubcos

The official data tells an unambiguous story: the 36-point chasm in landlord satisfaction is the direct result of two opposing corporate philosophies—one, a ‘community partnership’ model built for long-term stability, and the other, a private equity-driven model where tenants become collateral in a high-stakes financial strategy.

This tale of two pubcos poses a critical question for the future of the tenanted pub model. As the industry continues to face economic headwinds, will pubcos be forced to choose between supporting their tenants as partners or treating them as assets on a balance sheet? For anyone dreaming of running their own pub, the answer could make all the difference.NotebookLM can be inaccurate; please double check its responses.