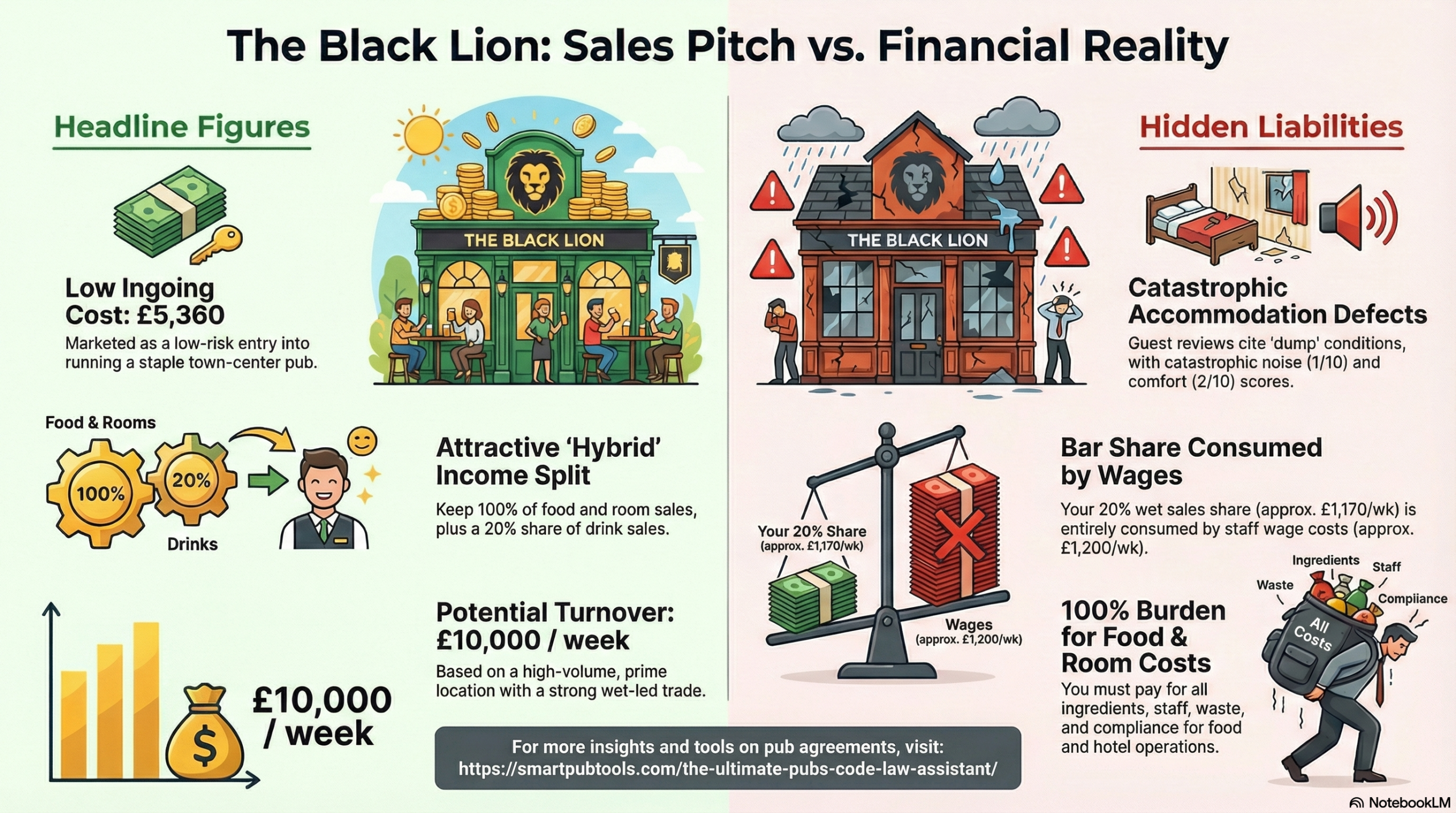

Marston’s presents an enticing opportunity: take the helm of a “staple” town-center pub for a low-risk entry fee of just £5,360 under a “Retail Agreement.” The deal is sweetened by a “Hybrid” split, where the new operator keeps a seemingly generous 20% of all wet sales, plus 100% of the revenue from food and letting rooms. It’s positioned as the best of both worlds—corporate backing on beer and entrepreneurial freedom on everything else.

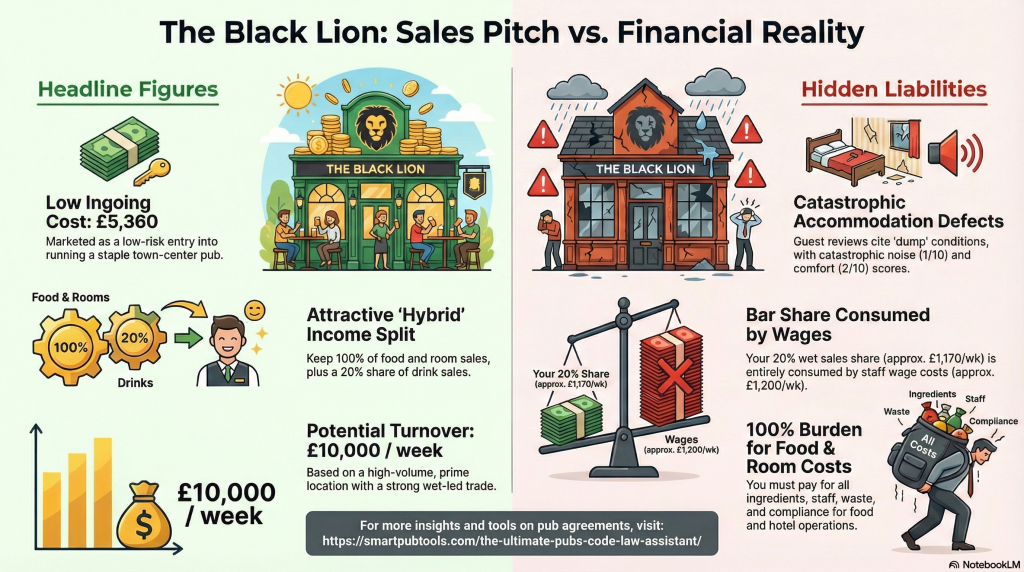

However, a forensic audit of the numbers exposes this as a classic “Split Trap.” The operator’s 20% commission on wet sales must cover all staff wages—a razor-thin margin that will be completely consumed by the April 2025 National Living Wage increase. Meanwhile, the operator bears 100% of the financial risk and operational burden for the food business and the dilapidated, complaint-riddled accommodation business. The very asset driving bar revenue—a late 1 am license—is the poison killing the accommodation business, creating a fundamental, structural conflict that a new operator inherits on day one.

2. The Financial Reality Check: Why This “Generous” Deal Fails the Numbers Test

The pub’s historical average weekly turnover is £6,500, with a sales mix heavily skewed towards drinks: 90% wet sales (£5,850) and just 10% from food and rooms (£650). This lopsided revenue stream is the foundation of the financial trap.

Operator’s Weekly Profit & Loss Breakdown

| Label | Calculation |

| Gross Weekly Income | (20% of £5,850 Wet Sales) + (100% of £650 Food/Rooms) = £1,820 |

| Estimated Weekly Liabilities | ~£1,200 (Staff Wages) + ~£30 (Council Tax) + ~£15 (Liability Insurance) = ~£1,245 |

| Estimated Net Profit (Pre-Tax) | £1,820 - £1,245 = £575 |

| Key Insight | The operator’s take-home pay is less than £600/week before tax, while bearing all operational risk for food and accommodation. |

This precarious model is further destabilized by two unavoidable market pressures: the high seasonality of Scarborough, where weekly turnover can plummet below £4,000 in the winter months while fixed costs remain, and the intense local price competition from the nearby Wetherspoons, The Lord Rosebery, which puts a hard ceiling on drink prices and squeezes the already minimal wet sales commission.

3. Operational Risks & Opportunities: The Goldmine and the Landmine

The business is a study in contrasts, with exceptional intangible assets being undermined by catastrophic physical failings. For a savvy operator, this presents both a clear danger and a significant opportunity.

3.1 The Landmine: What Guest Reviews and Data Reveal

The accommodation business is in a state of operational failure, as evidenced by verified guest review scores from KAYAK:

• Noise Level: 1.0 / 10.

• Bed Comfort: 2.0 / 10.

These scores reflect a fundamentally broken product. Direct quotes from recent, verified guest reviews paint a grim picture, describing the rooms as a "dump," with "wallpaper hanging off," "broken toilet seats," and "non-working heating." This physical neglect is compounded by other operational weaknesses, including reports of "slow service" at the bar and a customer complaint about waiting "over a month" for a simple refund, indicating potential administrative failures.

3.2 The Goldmine: Turning Failure into Profit

For a competent operator, these deep-seated failures represent clear, actionable opportunities to add value and drive profit.

1. Leverage the Prime Location. The pub’s central location is its greatest strength, earning guest review scores as high as 9.5 out of 10. It is perfectly positioned to attract tourists and locals alike, providing a constant stream of potential customers.

2. Capitalize on a Strong Staff Base. Despite the property’s physical flaws, the staff’s service is highly rated at 8.5 out of 10. This provides a solid human capital foundation to build upon, ensuring a positive customer experience from day one.

3. Exploit the Low-Labor Food Model. The food offering is built around reliable, pre-prepared products like “Pieminister Pies.” This smart, low-labor model minimizes the need for highly skilled kitchen staff, controls food costs, and ensures consistent quality.

4. Monetize the Entertainment License. The venue holds a valuable late license (1 am on Saturdays) and has live music capabilities. However, it currently lists no formal events on platforms like Skiddle. This dormant license is a high-margin, low-overhead revenue stream that a competent operator can immediately activate.

5. Negotiate the Refurbishment. The listing’s “Refurbishment Planned” status is the single most powerful negotiation tool. A prospective operator has critical leverage to demand that Marston’s commits capital expenditure (CAPEX) to completely overhaul the letting rooms before any agreement is signed.

4. The Verdict: Who Should Sign and Who Must Walk Away

This analysis leads to a clear and unambiguous conclusion about the ideal operator for this specific asset.

This opportunity is NOT for a first-timer. It requires an experienced couple or a hands-on team where one partner can run the kitchen as a chef and the other can manage the bar. This is the only viable way to reduce the crippling staff wage costs that would otherwise consume all profits.

Anyone looking for a simple management job, first-time pub operators, or any party unable to secure a legally binding, written commitment from Marston’s to fully refurbish the guest rooms before they take over must walk away. The potential profit is entirely dependent on the room income, and trading with them in their current state is a recipe for financial failure and reputational damage.

Do not proceed without getting a direct, unambiguous answer to this killer question:

The guest reviews consistently mention broken fixtures and poor conditions in the letting rooms. Is the planned refurbishment budget allocated specifically to bringing the letting rooms up to a sellable standard before I take the keys?

5. Your Next Move

Don’t rely on guesswork. Run this lease through our specialist AI Trap Detector tool before you sign anything.