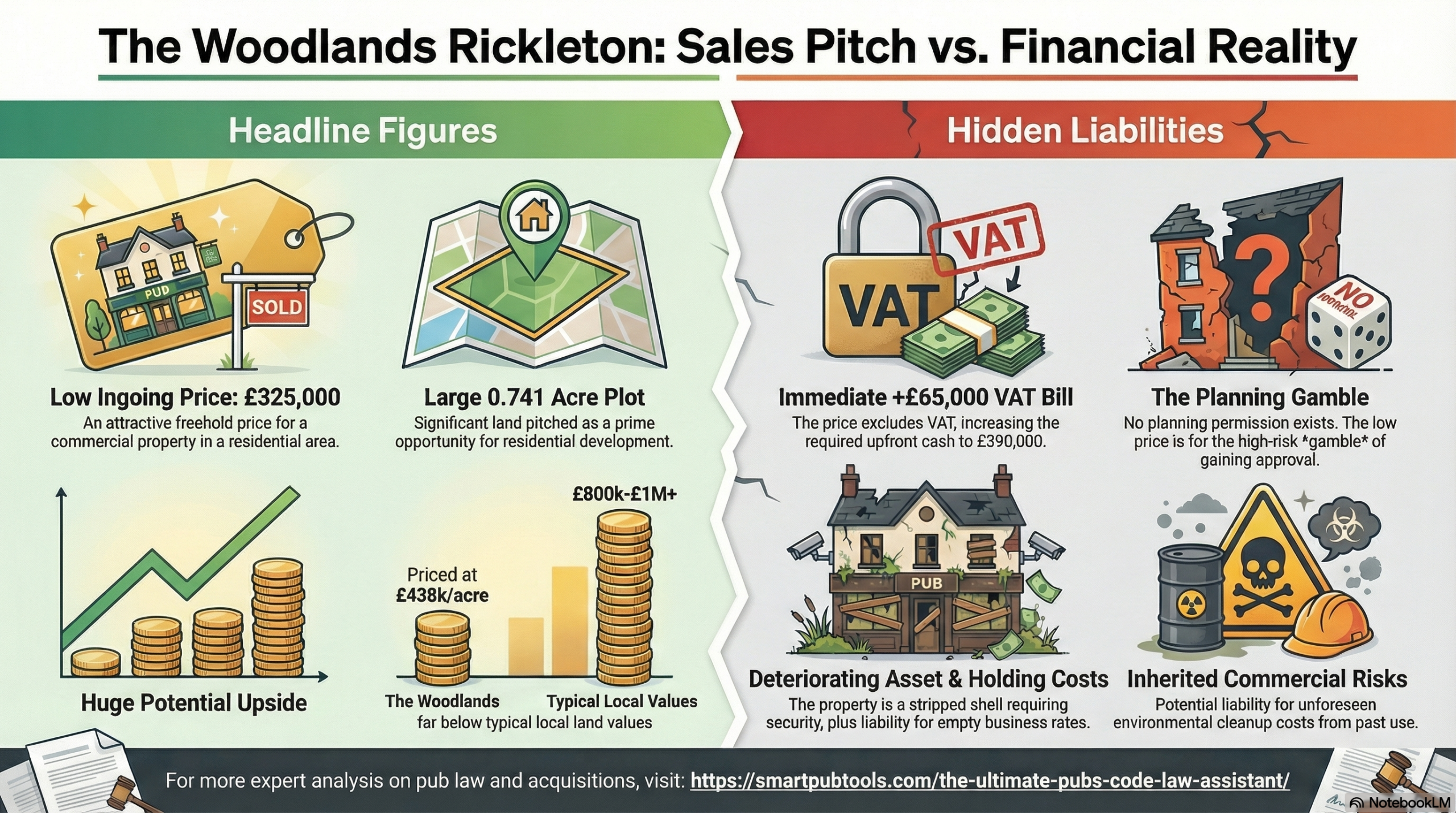

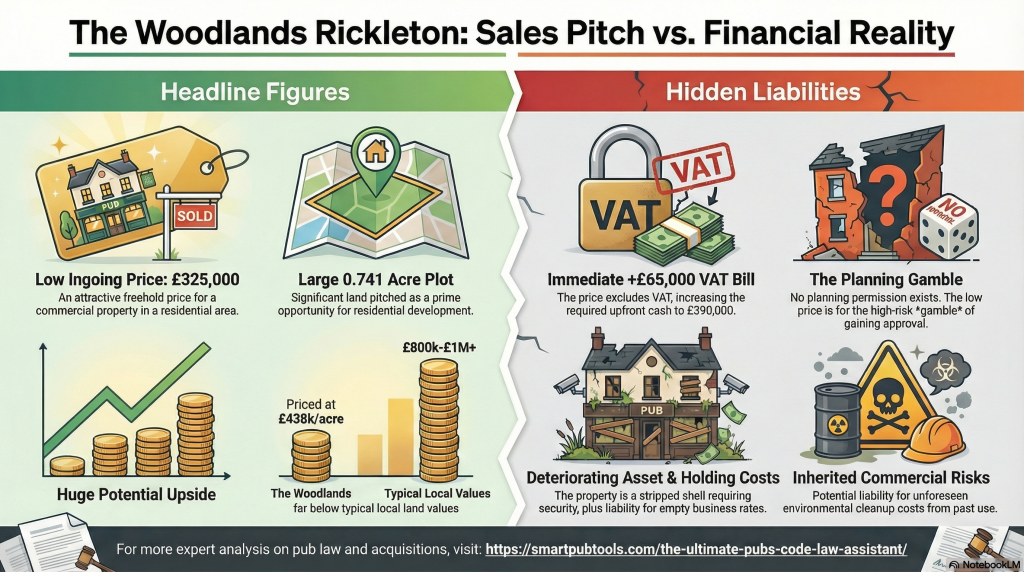

On the surface, the opportunity seems compelling: a large pub, The Woodlands, on a 0.741-acre plot in a residential corner of Rickleton, listed for a seemingly low “Offers in Region of £325,000”. But this is no typical business sale; it is a forced liquidation by Stonegate Group, the UK’s largest and most indebted pub operator. Facing a £3 billion debt pile and having warned of “material uncertainty” about its ability to continue as a “going concern,” Stonegate is on a ticking clock. The company is under extreme pressure to offload assets before the “non-call period” on a key loan expires in January 2025. The agent’s signal—”Would Suit Alternative Uses”—and the bargain-basement price confirm the harsh reality: this is a speculative “Land Play” for residential development, not a pub reopening. The attractive price tag is a carefully laid lure, concealing significant financial and legal traps that any potential buyer must understand.

——————————————————————————–

2. The Financial Reality Check: A Deal Riddled with Hidden Costs

This is a freehold sale, not a lease opportunity, meaning there are no turnover figures to analyze. Instead, the focus must be entirely on the capital investment risks, which are substantial and immediate.

The Deceptive Asking Price

The asking price is listed as “Offers in Region of £325,000”. However, the first trap is buried in the fine print. The price is “Plus VAT,” which instantly adds £65,000 to the upfront cash requirement. This brings the real initial outlay to a minimum of £390,000, a significant unadvertised cost that immediately changes the deal’s financial profile.

Project: THE WOODLANDS

Strategic Acquisition & Planning Assessment

Status: HIGH RISK / HIGH REWARD

Date: Late 2025

The Deceptive “Bargain”

On the surface, The Woodlands listing appears to be a cheap pub opportunity at £325,000. However, our analysis confirms this is a forced liquidation by Stonegate Group. The asset is distressed, the price is a carefully calculated “lure,” and the real opportunity is a speculative “Land Play” for residential development.

Financial Reality Check

The asking price is misleading. This is a freehold sale subject to VAT, significantly increasing the initial capital requirement. Furthermore, the massive valuation gap between the unconsented asking price and local developed land values signals the extreme planning risk involved.

The Hidden Cost Structure

Breakdown of immediate capital requirements vs. listed price.

The Land Value Arbitrage

Comparison of acquisition cost vs. potential consented value per acre in Rickleton (2025 Data).

The Seller’s Crisis

Stonegate Group is facing a liquidity crisis. With a £3 Billion debt pile and a key loan non-call period expiring in Jan 2025, they are forced to liquidate assets.

- ● Disposing of 1,000 “Platinum” Pubs

- ● Warning of “Material Uncertainty”

- ● Urgent need for clean cash deals

Stonegate Financial Position (Late 2025 Estimates)

The “Loss of Amenity” Strategy

To unlock the land value, the buyer must overcome Sunderland Council’s Core Strategy Policy VC5, which protects community assets. The strategy relies on proving the pub is “no longer required.”

Acquisition

Leverage Stonegate’s distress for an unconditional lowball offer.

Evidence Gathering

Document the failed 2024 reopening and Stonegate’s own disposal as proof of failure.

Planning Application

Submit for residential use (6-8 units) citing Policy VC5 exceptions.

Risk Profile

This is not an investment for amateurs. The risk is multifaceted, involving legal, financial, and regulatory hazards.

Ideal Buyer Profile:

- Cash Reserves > £500k

- Specialist Planning Team

- VAT “Opt to Tax” Experience

- High Risk Tolerance

Risk Dimensions (Scale 1-10)

The Price-Per-Acre Red Flag

Based on the £325,000 price for the 0.741-acre plot, the cost calculates to approximately £438,000 per acre. When contrasted with the typical value of residential development land in the area—which fetches between £800,000 and £1 million+ per acre—this massive discount is not a gift. It is the clearest possible signal that no planning permission exists for residential development. A buyer is not purchasing a ready-to-build site; they are purchasing a high-risk gamble on gaining that permission from the local council.

The Local Valuation Gap

A critical analysis of local property values reveals a dangerous discrepancy between the wider Rickleton area and the specific street where the asset is located. This valuation gap is a critical warning sign that the market has already priced in underlying issues with this specific location.

| Location | Average Detached Property Price (Last Year) |

| Rickleton (Wider Area) | £425,083 |

| Woodlands (Specific Street) | £291,501 |

This 31% valuation gap is a red flag identified in strategic risk assessments of the deal. It strongly suggests that any developer would be foolish to base their financial projections on the higher Rickleton average. This localized discount is a clear market signal that a developer’s profit margin is already compressed before a single shovel hits the ground.

——————————————————————————–

3. Operational Risks vs. Development Opportunities

The property presents two paths, but only one is grounded in reality. One is a high-risk gamble; the other is a proven financial dead end.

The Pub Operation: A Proven Failure

The evidence is overwhelming that attempting to reopen The Woodlands as a pub would be a catastrophic business decision.

• The Seller’s Verdict: Stonegate is the UK’s largest and most experienced pub operator. Their decision to dispose of this asset is the ultimate proof that they, with all their market intelligence, see no viable future for it as a pub.

• Recent History: The property is officially designated as “Closed Long Term.” A brief attempt to reopen it in July 2024 failed almost immediately, confirming that the local market cannot sustain the business.

• Physical State: The site is now surrounded by “security fencing,” a clear sign that it is a distressed, non-operational shell. It is likely stripped of all valuable fixtures and is actively deteriorating, representing a liability, not a business.

The Development Play: A High-Stakes Gamble

The genuine opportunity lies in a speculative land acquisition. The 0.74-acre plot could potentially accommodate 6-8 detached homes, subject to planning. The primary strategic advantage is the chance to acquire land at a discount from a financially distressed seller. Stonegate is under immense pressure to sell assets to service its £3 billion debt pile and has issued a formal warning of “material uncertainty” about its ability to continue as a “going concern,” making it highly motivated to accept a certain and rapid sale.

However, the path to development is fraught with sophisticated risks that go far beyond a standard residential project:

• Planning Permission Risk: A new owner must navigate Sunderland Council’s “Loss of Amenity” policy. Crucially, this requires proving the pub is “unviable” before demolition is permitted. Stonegate’s own disposal of the asset is the single strongest piece of evidence to support this claim, effectively turning the seller’s failure into the buyer’s key planning argument.

• Commercial Liability Transfer: The buyer risks inheriting severe liabilities. Under the Environmental Protection Act 1990, a new owner can be held responsible for the costs of cleaning up historical environmental contamination—a significant risk for a former pub. A standard search is insufficient; an enhanced “Phase 1 Desk Study” is mandatory. Furthermore, the title may be burdened with hidden defects like restrictive covenants or third-party rights to light, requiring specialist legal indemnity insurance.

• The VAT Complexity Trap: To reclaim the upfront £65,000 VAT payment, the new owner must “opt to tax” the building. This creates a financial trap down the line, as a future residential development will generate VAT-exempt rental or sales income, complicating the financial structure and potentially negating the initial benefit.

• Community Opposition: Access to the site appears to be through existing residential estate roads. Any proposal involving heavy construction traffic is likely to face significant and organized opposition from residents.

——————————————————————————–

4. The Verdict: Who Should Bid and Who Must Walk away?

This deal is not for everyone. The risk profile is extreme, and only a specific type of buyer should even consider it.

Who This Opportunity Is Right For:

The ideal buyer is an experienced, cash-rich property developer backed by a specialist legal and planning team. This firm must possess a high-risk appetite and the financial depth to absorb the upfront VAT, ongoing holding costs, and potentially significant, uncosted environmental remediation expenses. Their core strategy should be to leverage Stonegate’s corporate desperation. By offering a rapid, certain, and clean sale—thereby solving the seller’s urgent liquidity problem—they can take on all the planning and conversion risks in exchange for a potentially favorable acquisition price.

Who Should Avoid This Deal:

Anyone else. This includes any aspiring publican, first-time property investor, or small-scale developer. Anyone looking for a turnkey business, a steady income stream, or a straightforward property investment will be financially ruined by this deal’s hidden costs and labyrinthine complexities. This is a professional-grade, high-risk development play masquerading as a pub sale. For the unprepared, it is a financial trap.